On February 1, Mr. Barnes purchased a business from Mr. and Mrs. Sanchez for a lump-sum price

Question:

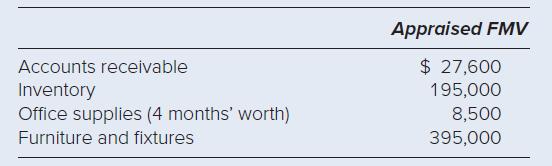

On February 1, Mr. Barnes purchased a business from Mr. and Mrs. Sanchez for a lump-sum price of $750,000. The business included the following balance sheet assets:

By buying the business, Mr. Barnes acquired a favorable lease on office space with a remaining term of 31 months; he estimates that the value of this lease is $20,000. The purchase contract stipulates that Mr. and Mrs. Sanchez will not engage in a competitive business for the next 36 months. Discuss how Mr. Barnes can recover the cost of each of the business assets acquired in this purchase.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted: