Pracht, a popular cosmetics company in Germany, has been performing favorably and growing at a constant rate,

Question:

Pracht, a popular cosmetics company in Germany, has been performing favorably and growing at a constant rate, with profits exceeding $900,000 in the last financial year. The company now wants to expand its market by creating a new product range that is suitable for vegans, is free of chemicals, and has not been tested on animals.

Sales figures in the cosmetics industry suggest this is a fast-growing trend, and Pracht’s recent market research suggests that ethics are an important consumer consideration when shopping for make-up. As part of the new product range, the organization also plans to launch a new brand image to demonstrate their commitment to cruelty-free products. Paul, the business development manager, is currently assessing two investment opportunities with entrepreneurs who are trying to get their ethical products to market.

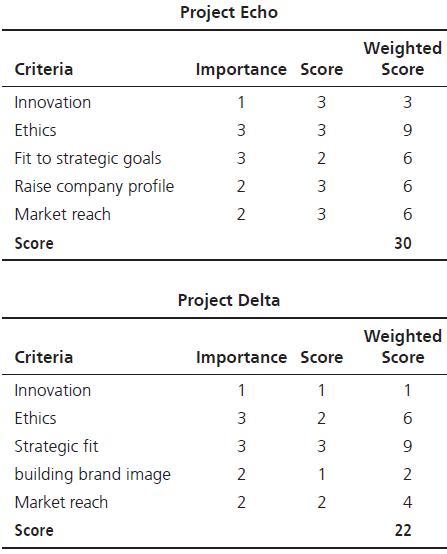

To help him reach a decision, Paul had sent the project proposals to two key decision makers within the organization and asked them to present their results at the monthly management meeting. Mia, a new employee responsible for the corporate social responsibility arm of the company, and Jonas, the financial director, assessed the proposals and presented their findings. Mia used a simple scoring model, based on the key strategic categories at Pracht, to evaluate the two projects. The categories she employed were 1) innovation, 2) ethics, 3) strategic fit, 4) building brand image, and 5) market reach. Using these categories, Mia and Jonas evaluated the two projects as shown here. The scores were 1 = low, 2 = medium, and 3 = high.

During the meeting, Mia argued that Project Echo was the most appropriate project to invest in due to their level of commitment to ethical practices and the level of innovation demonstrated, which would be fundamental in launching this type of product range.

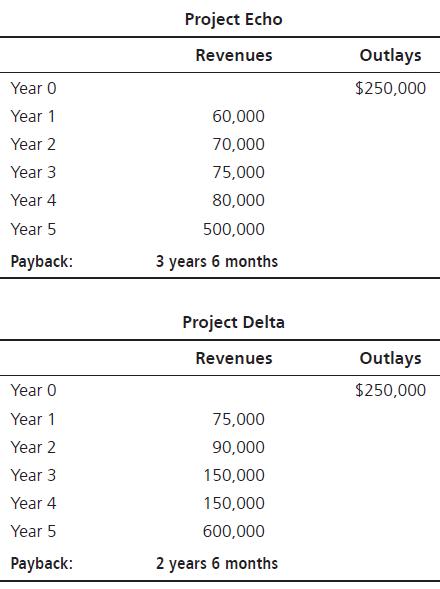

The entrepreneur had also demonstrated that they had an existing customer base that they could bring with them. Jonas calculated the investment of the project using the payback period model. His findings were as follows:

Jonas argued that, financially, Project Delta would ensure return on investment 12 months earlier than Echo, and projections show that at the five-year mark Delta would generate 16% more revenue for the company.

At the end of the meeting, Paul is still unclear on which project to invest in. Should he invest in the project that makes the company the most money? This is ultimately the purpose of any business—to drive profits for shareholders and re-invest in growth.

However, the re-branding of Pracht is also a fundamental part of business growth, where ethics and responding to a growing market of customers who believe in chemical and cruelty-free products are important.

Paul decides to re-visit the project screening tools to refine them before asking a wider selection of staff to evaluate the choices.

Questions

1. Which project would you invest in based on the selection tools used? Be prepared to justify your answer.

2. What are the advantages and disadvantages of the tools presented in this case?

3. What can you learn from this case when considering what project selection methods might be suitable for use within an organization?

Step by Step Answer:

Project Management Achieving Competitive Advantage

ISBN: 9781292269146

5th Global Edition

Authors: Jeffrey K.Pinto