Reversed convertibles have been proposed, after the subprime crisis, as a potential safeguard against bank failures. Kashyap

Question:

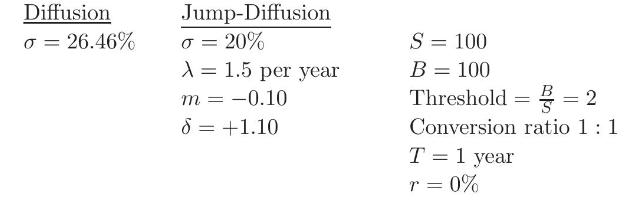

Reversed convertibles have been proposed, after the subprime crisis, as a potential safeguard against bank failures. Kashyap et al. (2008) analyse a reverse convertible bond with face value of \(\$ \mathrm{~B}\) which will be turned into \(n\) number of equity shares when the leverage ratio hits a fixed threshold or the equity value falls below a threshold. Pennacchi et al. (2010) suggest the use of a call option enhanced reverse convertible (see also Schoutens (2011). Given the following parameters for the jump-diffusion and diffusion models, calculate the price of a reverse convertible under each of these two dynamics: The conversion threshold suggests conversion will take place when share price drops to \(50=\frac{100}{2}\). Hence, the reverse convertible can be considered as a portfolio of a short put with strike price 50, and a cash or nothing digital call also strike at 50. With appropriate assumption, e.g. normal or lognormal jump size, the options can be valued using the solution in Merton (1990) and in this chapter. Alternatively, you can solve this question numerically by simulations.]

(Kashyap et al. 2008; Pennacchi et al. 2010; Schoutens, 2011).

Step by Step Answer: