Question

1. Bridger Company currently has the capacity to manufacture 250,000 widgets a year. The widgets normally sell for $8.00 each. Bridger Company has the following

1. Bridger Company currently has the capacity to manufacture 250,000 widgets a year. The widgets normally sell for $8.00 each.

Bridger Company has the following costs related to manufacturing and selling 200,000 widgets:

Direct materials???????????????..$300,000

Direct labor?????????????????$540,000

Variable manufacturing overhead????????.$180,000

Depreciation on equipment only used for the widgets...$40,000

Depreciation on factory????????????$100,000

Salary of widget production manager ???????$70,000

Variable selling costs (commissions)???????..$60,000

Fixed selling costs??????????????...$80,000

Total???????????????????$1,370,000

Assume Minot Inc. asks Bridger to complete a manufacture a special order of 10,000 widgets. Minot is willing to pay $5.50 per widget (and the sales commission will apply on this special order).

By how much will Bridger's income change if they accept the special order?

a. $4,000 increase

b. $1,000 increase

c. $13,500 decrease

d. $1,000 decrease

e. $25,000 decrease

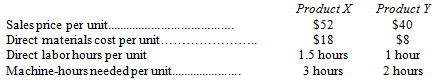

2. Consider the following production and cost data for two products, X and Y, manufactured by Alphabet Company.

? The labor rate is $10 per hour.

? Variable overhead is $2 per direct labor hour.

? The company has 15,000 machine hours available each period, and there is unlimited demand for each product.

What is the largest possible total contribution margin that can be earned each period?

a. $105,000

b. $150,000

c. $120,000

d. $124,000

e. $111,000

3. Porker Enterprises produces ham from locally raised pigs.

The cost of getting the pig ready for market is about $80 per pig. $7 of that has been allocated to the ham portion of the pig.

Each pig produces a ham that is approximately 12 pounds and sells for $1.50 per pound.

Porker can smoke the hams for an additional $6 per ham. The smoked ham will sell for $2.25 per pound.

By how much will Porker's income change if they smoke 300 hams (label as an increase or decrease) as opposed to selling them as is?

a. $1,200 decrease

b. $2,700 increase

c. $900 increase

d. $900 decrease

e. none of the above

4. Aloussim Industries manufactures a product with the following costs per unit at capacity of 30,000 units.

Direct materials.............................. $5

Direct labor................................... $15

Variable manufacturing overhead...$8

Fixed manufacturing overhead...... $6

The company is currently operating at capacity (they cannot produce more than 30,000 units). The product regularly sells for $45. A wholesaler has offered to pay $40 each for 2,000 units.

What is the effect on net income, if Aloussim Industries accepts the special order?

a. $24,000 increase

b. $34,000 increase

c. $10,000 decrease

d. $12,000 decrease

e. none of the above

Sales price per unit...... Direct materials cost per unit.. Direct labor hours per unit Machine-hours needed per unit.. Product X $52 $18 1.5 hours 3 hours Product Y $40 $8 1 hour 2 hours

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 c 13500 dec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started