Question

1. The DiPalma Jewelry Store uses the accounts receivable aging method to estimate uncollectible accounts. The balance of the Accounts Receivable controlling account was a

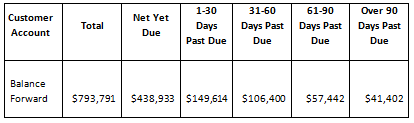

1. The DiPalma Jewelry Store uses the accounts receivable aging method to estimate uncollectible accounts. The balance of the Accounts Receivable controlling account was a debit of $446,341 and the balance of Allowance for Uncollectible Accounts was a credit of $43,000 at February 1, 19x1. During the year, the store had sales on account of $3,724,000, sales returns and allowances of $63,000, worthless accounts written off of $44,300, and collections from customers of $3,214,000. As part of the end-of-year (January 31, 19x2) procedures, an aging analysis of accounts receivable is prepared. The totals of the analysis, which is partially complete, follow.

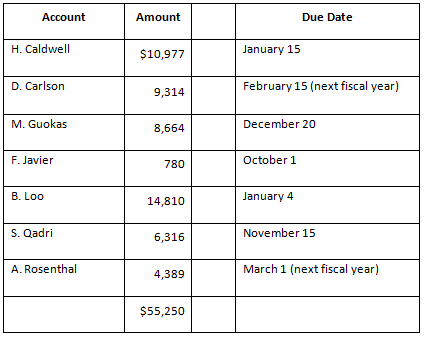

The following accounts remain to be classified to finish the analysis.

The following accounts remain to be classified to finish the analysis.

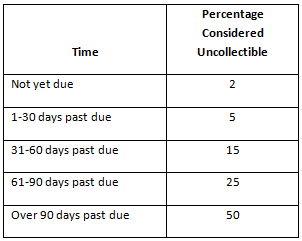

From past experience, the company has found that the following rates are realistic to estimate uncollectible accounts.

From past experience, the company has found that the following rates are realistic to estimate uncollectible accounts.

From past experience, the company has found that the following rates are realistic to estimate uncollectible accounts.

REQUIRED:

REQUIRED:

Complete the aging analysis of accounts receivable.

- Determine the end-of-year balances (before adjustments) of Accounts Receivable and Allowance for Uncollectible Accounts.

- Prepare an analysis computing the estimated uncollectible accounts.

- Prepare a general journal entry to record the estimated uncollectible accounts expense for the year (around the adjustment to the nearest whole dollar).

2. Mitsubishi Electric Corp., a broadly diversified Japanese corporation, instituted a credit plan called Three Diamonds for customers who buy its major electronic products, such as large-screen televisions and video tape recorders, from specified retail dealers. Under the plan, approved customers who make purchases in November 1994 do not have to make any payments until January 1996 and pay no interest for the intervening months. Mitsubishi pays the dealer the full amount less a small fee, sends the customer a Mitsubishi credit card and collects from the customer at the specified time. What is Mitsubishi?s motivation for establishing such generous credit terms? What costs are involved? What are the accounting implications?

3. All companies that sell on credit face the risk of bad debt losses. For example, in 1992, L.A. Gear Inc., the well-known maker of athletic footwear, had an allowance for uncollectible accounts of $6.9 million on accounts receivable of $63.0 million. Its 1992 sales were $430.2 million. What two methods are available to L.A. Gear Inc. For estimating uncollectible accounts expense? Contrast the two methods, including their relationships to the financial statements. Which method would you expect L.A. Gear Inc. to use? Why.

Customer Account Total Net Yet Due 1-30 Days Past Due Balance Forward $793,791 $438,933 $149,614 31-60 Days Past Due $149,614 $106,400 61-90 Days Past Due $57,442 Over 90 Days Past Due $41,402 Account H. Caldwell D. Carlson M. Guokas F. Javier B. Loo S. Qadri A. Rosenthal Amount $10,977 9,314 8,664 780 14,810 6,316 4,389 $55,250 January 15 February 15 (next fiscal year) Due Date December 20 October 1 January 4 November 15 March 1 (next fiscal year) Time Not yet due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Percentage Considered Uncollectible 2 5 in 15 25 50

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 2 The End of Year Balance Sales During the Year 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609887f5caf7f_28944.pdf

180 KBs PDF File

609887f5caf7f_28944.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started