Question: 1. Why do you think Rolls has continued to bear this structural currency mismatch so long? Why hasn't it done what many automobile companies have

1. Why do you think Rolls has continued to bear this structural currency mismatch so long? Why hasn't it done what many automobile companies have done, and move some of their manufacturing and assembly to the country in which the customer resides?

2. Why are Rolls-Royce's foreign currency hedges performing so poorly? Shouldn't the hedges be protecting its sales and earnings against exchange rate movements? 3. If you were a member of the leadership team at Rolls-Royce, what would you recommend the company do to manage the risks arising from Brexit?

Rolls said it "remains committed to the UK where we are headquartered, directly employ over 23,000 talented and committed workers and where we carry out a significant majority of our research and development. The UK's decision will have no immediate impact on our day-to-day business" ?.Business as usual' for Rolls-Royce as it remains on course despite Brexit, The Telegraph, 28 June 2016.

The decision by the people of the United Kingdom to leave the European Union? Brexit ?in June of 2016 raised many questions over the future of many of the U.K.'s multinational firms. One firm in the limelight was Rolls-Royce, one of the premier aerospace engine manufacturers in the world. Rolls was one of Britain's major exporters, credited with roughly 2% of the country's annual exports. Following Brexit, and the sharp decline in the British pound sterling, analysts were attempting to gauge how the EU exit would alter the company's business, and how the company's leadership was likely to react.

Rolls-Royce Holdings PLC is a U.K.-based multinational group that designs, manufactures, and distributes power systems to the aviation (civil and defense), marine, nuclear, and other industries 2 .It is listed on the London Stock Exchange (LSE: RR) and is a member of the FTSE 100 index. It is the second largest manufacturer of aircraft engines in the world, and closed 2015 with ?13.725 billion in revenue and ?0.084 billion in net income. In recent years nearly all of its profits have come from the aerospace sector.

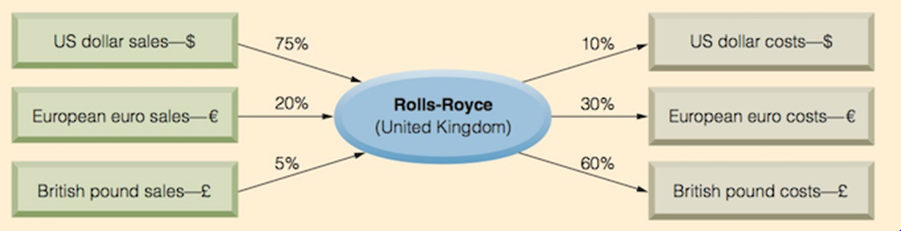

But Rolls had a serious, long-term, structural currency problem. Although based in the U.K., with most of its manufacturing operations in British pounds, its global sales were dominated by the U.S. dollar. This reflected the location and identities of its major customers like Boeing and Airbus. As illustrated in Exhibit A, this structural currency mismatch meant the company had a significant operating exposure problem, earning primarily U.S. dollars when paying out British pounds and euros. (Because many of the pieces, parts, and subcomponents used by Rolls were sourced from Continental Europe, the euro was a net short position for the company as well.

EXHIBIT A: Currency Structure of Rolls - Royce's Global Business

Rolls-Royce's business was structurally mismatched by currency. Although global sales were dominated by the U.S. dollar, costs were still largely British pound-based.

The result was a multinational company that was long U.S. dollars and short British pounds. If the U.S. dollar then appreciated versus the British pound, Rolls-Royce benefits. If, however, the dollar was to fall in value versus the pound, sales, earnings, and cash flows would fall in value as reported in British pounds.

Since many of Rolls' sales programs were lengthy, often between three and six years in length, this long-dollar position was not only large, it was relatively predictable over time.

The Hedging Program

"Rolls-Royce operates in a number of very long cycle businesses and we therefore have a long-term hedging program "Rolls-Royce operates in a number of very long cycle busi-nesses and we therefore have a long-term hedging program to provide a degree of certainty to our cash flows going for-ward," Rolls-Royce spokeswoman Jane Terry said in an e-mailed statement 3 .

Rolls, like most multinationals, values predictability of cash flow. In an attempt to increase the predictability of British pound proceeds from sales, given the fluctuations of exchange rates, Rolls in 2012 had started a large?more than $20 billion?long-term currency hedging program, some of it more than six years in duration. The majority of the hedge program locked-in U.S. dollar revenues at an average of $1.60 per pound, using primarily forward con-tracts, for six years into the future, average of $1.60 per pound, using primarily forward contracts, for six years into the future.

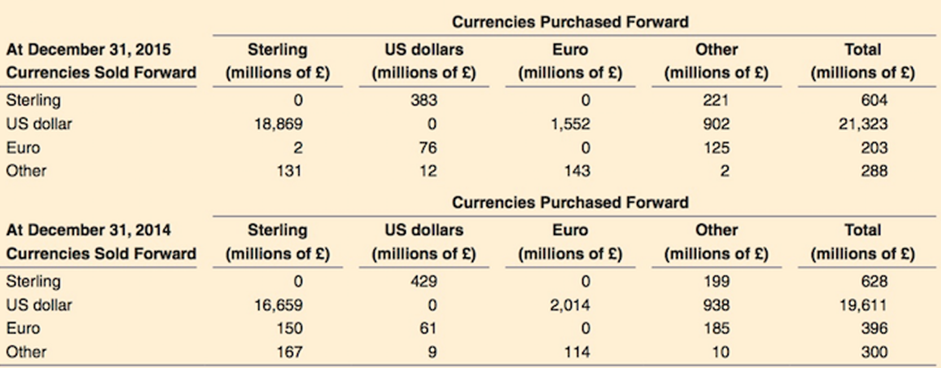

Exhibit B presents Rolls-Royce's currency derivatives program status as of December 31 for the previous two years. Note that the predominant value is the amount of U.S. dollars sold forward?mostly in exchange for Brit-ish pounds sterling, but some also for euros and other unnamed currencies.

EXHIBIT B: Derivative Financial Instruments R elated to Foreign Exchange Risks

As is the case with unpredictable markets, the hedges had not always proved profitable when viewed in hindsight. In the summer of 2014 the pound began to fall against the dollar, a favorable movement for Rolls that the company could not fully enjoy given its lock-in hedge program. As is always the case, locking-in a guaranteed rate meant that when the exchange rate moved in the company's favor, its protection would prove to be a cost, as it could not enjoy the favorable movement. Unfortunately, the pound's slide against the dollar had continued into 2016.

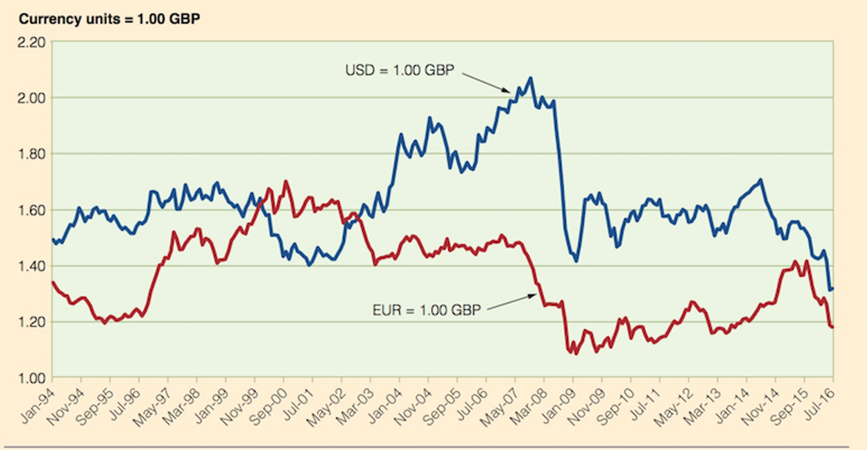

Publicly traded companies like Rolls must continually worry about short-term market movements while keeping long-term competitiveness in their sights. Although the company believes its long-term hedging program is in the long-term interests of the company, there will always be periods in the short-term that make the program appear to be a mistake (reflected in short-term share price movements). Exhibit C attempts to pro-vide some longer-term perspective to the challenge Rolls faces. The exchange rates that matter the most, the dollar and euro against the round, show varying periods of relative strength and weakness over the past 25 years. It is apparent from Exhibit C that the pound has enjoyed a long period of relative weakness against the dollar and euro. But the recent Brexit vote seems to have pushed it down to a level not seen in the past quarter century against the dollar, as well as approaching the historical lows versus the euro.

Brexit

Hey Europe, how's it going? Lost a few pounds lately? ?Note in London pub window, July 2016

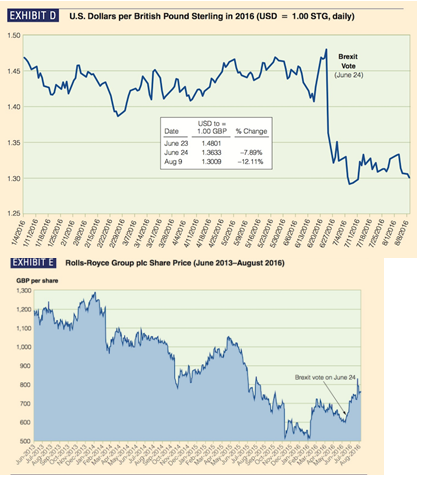

The British vote in June 2016 to exit the European Union was largely based on social and political issues, not economic or financial 4 . The U.K. had never adopted the euro, preferring these many years to keep the pound sterling and its monetary independence. The year 2016 had been a relatively stable one for the USD/GBP rate, at least up until the Brexit vote on June 24, as shown in Exhibit D. The vote had a distinctly negative impact on the value of the pound. By August the pound sterling was down more than 12% against the dollar.

But a weaker pound was essentially good news for Rolls, as shown in its share price bump following the vote and its first-half year results (see Exhibit E).

EXHIBIT C: Long- Term Exchange Rates of the Dollar, Euro, and pound

US dollar sales-$ European euro sales- British pound sales- 75% 20% 5% Rolls-Royce (United Kingdom) 10% 30% 60% US dollar costs $ European euro costs British pound costs At December 31, 2015 Currencies Sold Forward Sterling US dollar Euro Other At December 31, 2014 Currencies Sold Forward Sterling US dollar Euro Other Sterling (millions of ) 0 18,869 2 131 Sterling (millions of ) 0 16,659 150 167 US dollars (millions of ) 383 0 76 12 Currencies Purchased Forward Euro 429 0 61 9 US dollars (millions of ) (millions of ) 0 1,552 0 143 Currencies Purchased Forward Euro (millions of ) 0 2,014 0 Other (millions of ) 114 221 902 125 2 Other (millions of ) 199 938 185 10 Total (millions of ) 604 21,323 203 288 Total (millions of ) 628 19,611 396 300 Currency units = 1.00 GBP 2.20 2.00 1.80 1.60 1.40 1.20 1.00 Jan-94 Nov-94 Sep-95 Jul-96 May-97 Mar-98 Jan-99 Nov-99 Sep-00 Jul-01 USD 1.00 GBP May-02 EUR = 1.00 GBP Jan-04 Mar-03 Nov-04 Sep-05 Jul-06 May-07 Mar-08 Jan-09 wwwww www Nov-09 Sep-10 Jul-11 May-12 Mar-13 Jan-14 Nov-14 Sep-15 Jul-16 EXHIBIT D U.S. Dollars per British Pound Sterling in 2016 (USD = 1.00 STG, daily) 1.50 1.45 1.40 1.35 1.30 1/4/2016 1/11/2016 1/18/2016 1.25 1,200 1,100 1,000 900 800 700 9402/92/1 600 500 2/1/2016 2/8/2016 2/15/2016 2/22/2016 9102/622 3/7/2016 3/14/2016 3/21/2016 Date June 23 June 24 Aug 9 3/28/2016 4/4/2016 USD to 1.00 GBP % Change 4/11/2016 EXHIBIT E Rolls-Royce Group plc Share Price (June 2013-August 2016) GBP per share 1.300 mul 1.4801 1.3633 1.3009 -12.11% 4/18/2016 4/25/2016 5/2/2016 5/2016 5/16/2016 5/23/2016 9100/00/5 Brexit Vote (June 24) 6/6/2016 6/13/2016 6/20/2016 6/27/2016 9102/9/2 7/11/2016 Brexit vote on June 24 y 7/18/2016 7/25/2016 8/1/2016 8/8/2016

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

1 The Structural Currency Mismatch RollsRoyce has continued to bear the structural currency mismatch primarily due to several strategic choices and co... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6090693810d48_21689.pdf

180 KBs PDF File

6090693810d48_21689.docx

120 KBs Word File