Question

A company made the following merchandise purchases and sales during the current month: There was no beginning inventory. If the company uses the FIFO (first-in,

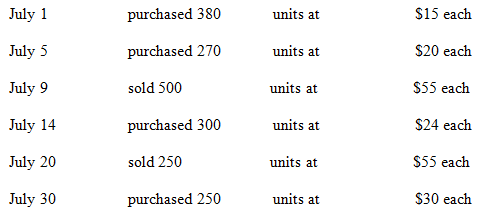

A company made the following merchandise purchases and sales during the current month:

There was no beginning inventory. If the company uses the FIFO (first-in, first-out) perpetual inventory system, what would be the cost of the ending inventory? What is the Cost of Goods Sold for each sale?

What is the cost of Goods Sold for each sale under LIFO?

July 1 July 5 July 9 July 14 July 20 July 30 purchased 380 purchased 270 sold 500 purchased 300 sold 250 purchased 250 units at units at units at units at units at units at $15 each $20 each $55 each $24 each $55 each $30 each

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

LIFO Receipts cost of Goods Sold Balance Date Description Qty Rate Amount Qty Rate Amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App