Question

At January 1, 2017, Tobita Merchants had a balance in the interest receivable account for several notes it had obtained from its customers in exchange

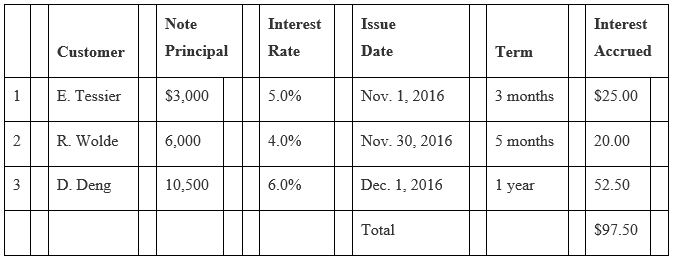

At January 1, 2017, Tobita Merchants had a balance in the interest receivable account for several notes it had obtained from its customers in exchange for outstanding accounts. The following is a table containing details of the notes receivable and the balance of the interest accrued on each note as of the end of the last fiscal year, December 31, 2016.

All notes require that the interest be paid at the maturity of the note. All notes and interest were paid on time. Tobita prepares adjusting journal entries at the end of its fiscal year.

Tobita transactions of 2017:

Mar. 1 Received a $12,000, twelve-month, 5.0% note from T. Lalonde in settlement of an accounts receivable. Interest is due at maturity.

Oct. 30 Received a $4,000, three-month, 4.0% note from J. Han in settlement of an accounts receivable. Interest is due at maturity.

Nov. 30 Lent B. Morgan $10,000 cash in exchange for a two-year 6.0% note with interest due at maturity.

Required:

Prepare all journal entries for Tobita Merchants for the all of the above transactions.

H 2 Customer E. Tessier R. Wolde D. Deng Note Principal $3,000 6,000 10,500 Interest Rate 5.0% 4.0% 6.0% Issue Date Nov. 1, 2016 Nov. 30, 2016 Dec. 1, 2016 Total Term 3 months 5 months 1 year Interest Accrued $25.00 20.00 52.50 $97.50

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Titles and Explanation Debit Credit Dec 31 Interest Receivable 9750 Interest Rev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6092184c15e19_22775.pdf

180 KBs PDF File

6092184c15e19_22775.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started