Question

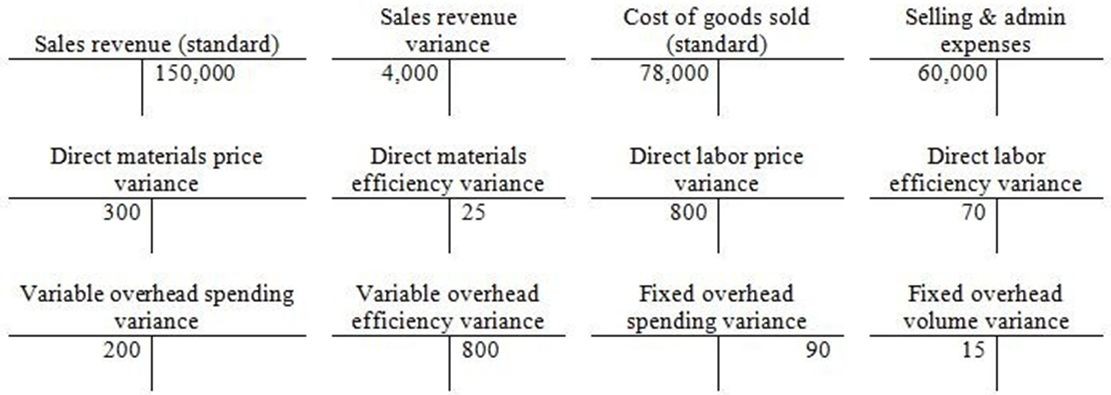

Atlas Inc. uses a standard costing system. Atlas's year ending balances at December 31, 2015 are shown here: Calculate standard net operating income of the

Atlas Inc. uses a standard costing system. Atlas's year ending balances at December 31, 2015 are shown here:

Calculate standard net operating income of the company for the year ended.

Sales revenue (standard) 150,000 Direct materials price variance 300 Variable overhead spending variance 200 Sales revenue variance 4,000 Direct materials efficiency variance 25 Variable overhead efficiency variance 800 Cost of goods sold (standard) 78,000 Direct labor price variance 800 Fixed overhead spending variance 90 Selling & admin expenses 60,000 Direct labor efficiency variance 70 Fixed overhead volume variance 15

Step by Step Solution

3.54 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Standard Cost Income Statement For the Year Ended December 31 2015 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting

Authors: William K. Carter

14th edition

759338094, 978-0759338098

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App