Brexit and Rolls-Roycel Rolls said it remains committed to the UK where we are headquartered, directly employ over 23,000 talented and committed workers and where

Brexit and Rolls-Roycel

Rolls said it "remains committed to the UK where we are headquartered, directly employ over 23,000 talented and committed workers and where we carry out a significant majority of our research and development. The UK's decision will have no immediate impact on our day-to-day business" ?'Business as usual' for Rolls-Royce as it remains on course despite Brexit, The Telegraph, 28 June 2016.

The decision by the people of the United Kingdom to leave the European Union?Brexit?in June of 2016 raised many questions over the future of many of the U.K.'s multinational firms. One firm in the limelight was Rolls-Royce, one of the premier aerospace engine manufacturers in the world. Rolls was one of Britain's major exporters, credited with roughly 2% of the country's annual exports. Following Brexit, and the sharp decline in the British pound sterling, analysts were attempting to gauge how the EU exit would alter the company's business, and how the company's leadership was likely to react.

The Business and Currency Hedging

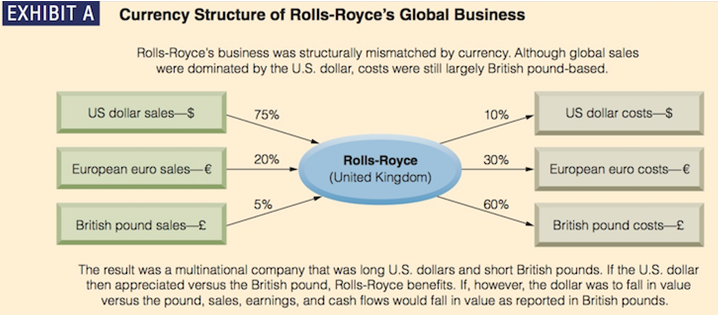

Rolls-Royce Holdings PLC is a U.K.-based multinational group that designs, manufactures, and distributes power systems to the aviation (civil and defense), marine, nuclear, and other industries? It is listed on the London Stock Exchange (LSE: RR) and is a member of the FTSE 100 index. It is the second largest manufacturer of aircraft engines in the world, and closed 2015 with ?13.725 billion in revenue and ?0.084 billion in net income. In recent years nearly all of its profits have come from the aerospace sector. But Rolls had a serious, long-term, structural currency problem. Although based in the U.K., with most of its manufacturing operations in British pounds, its global sales were dominated by the U.S dollar. This reflected the location and identities of its major customers like Boeing and Airbus. As illustrated in Exhibit A, this structural currency mismatch meant the company had a significant operating exposure problem, earning primarily U.S. dollars when paying out British pounds and euros. (Because many of the pieces, parts, and subcomponents used by Rolls were sourced from Continental Europe, the euro was a net short position for the company as well.) Since many of Rolls' sales programs were lengthy, often between three and six years in length, this long-dollar position was not only large, it was relatively predictable over time.

The Hedging Program "Rolls-Royce operates in a number of very long cycle busi-nesses and we therefore have a long-term hedging program

Rolls, like most multinationals, values predictability of cash flow. In an attempt to increase the predictability of Brit-ish pound proceeds from sales, given the fluctuations of exchange rates, Rolls in 2012 had started a large?more than $20 billion?long-term currency hedging program, some of it more than six years in duration. The majority of the hedge program locked-in U.S. dollar revenues at an average of $1.60 per pound, using primarily forward con-tracts, for six years into the future.

"Rolls-Royce operates in a number of very long cycle busi-nesses and we therefore have a long-term hedging program to provide a degree of certainty to our cash flows going for-ward," Rolls-Royce spokeswoman Jane Terry said in an e-mailed statement average of $1.60 per pound, using primarily forward con-tracts, for six years into the future.

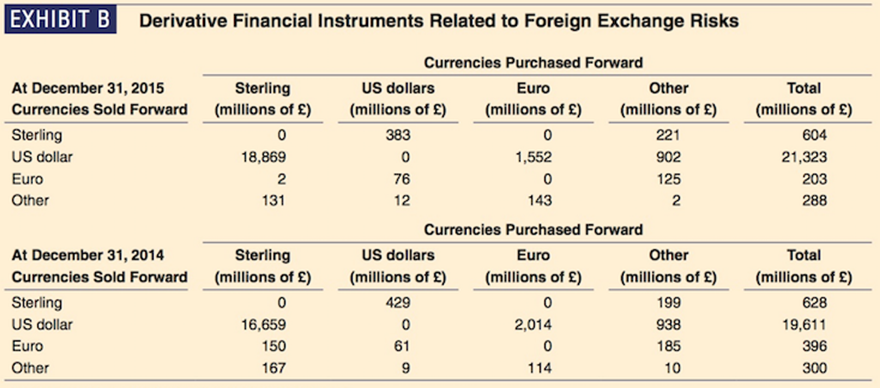

Exhibit B presents Rolls-Royce's currency derivatives program status as of December 31 for the previous two years. Note that the predominant value is the amount of U.S. dollars sold forward?mostly in exchange for British pounds sterling, but some also for euros and other unnamed currencies.

As is the case with unpredictable markets, the hedges had not always proved profitable when viewed in hindsight. In the summer of 2014 the pound began to fall against the dollar, a favorable movement for Rolls that the company could not fully enjoy given its lock-in hedge program. As is always the case, locking-in a guaranteed rate meant that when the exchange rate moved in the company's favor, its protection would prove to be a cost, as it could not enjoy the favorable movement. Unfortunately, the pound's slide against the dollar had continued into 2016.

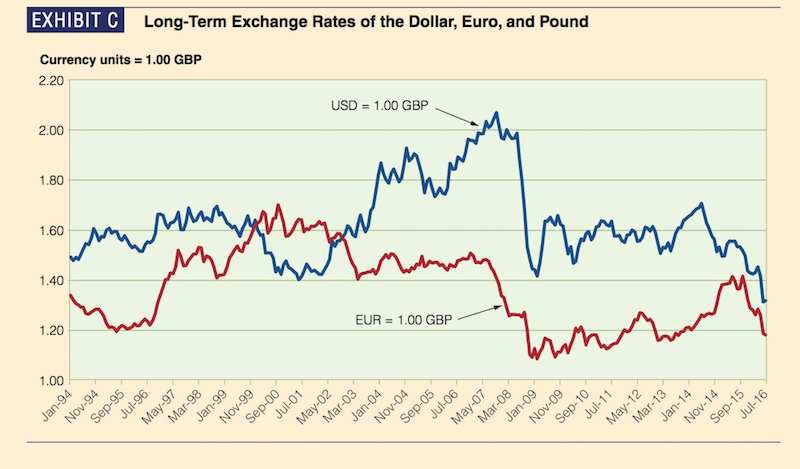

Publicly traded companies like Rolls must continually worry about short-term market movements while keeping long-term competitiveness in their sights. Although the company believes its long-term hedging program is in the long-term interests of the company, there will always be periods in the short-term that make the program appear to be a mistake (reflected in short-term share price movements). Exhibit C attempts to pro-vide some longer-term perspective to the challenge Rolls faces. The exchange rates that matter the most, the dollar and euro against the pound, show varying periods of relative strength and weakness over the past 25 years. It is apparent from Exhibit C that the pound has enjoyed a long period of relative weakness against the dollar and euro. But the recent Brexit vote seems to have pushed it down to a level not seen in the past quarter century against the dollar, as well as approaching the historical lows versus the euro.

Brexit

Hey Europe, how's it going? Lost a few pounds lately? ?Note in London pub window, July 2016

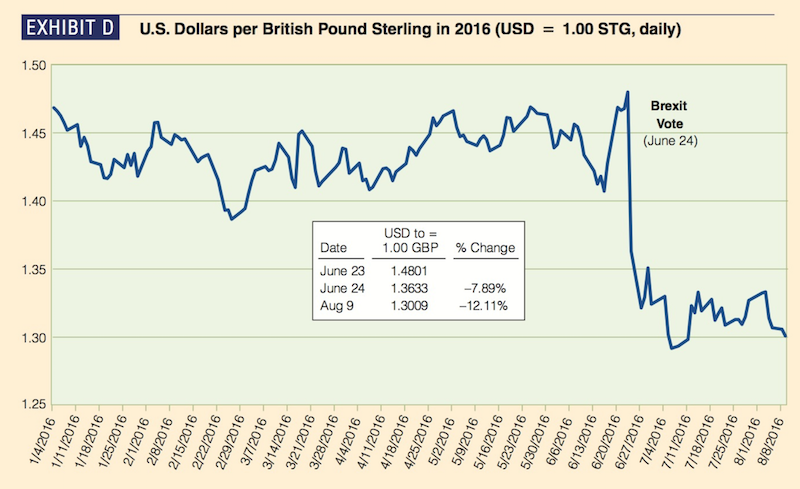

The British vote in June 2016 to exit the European Union was largely based on social and political issues, not eco-nomic or financial .? The U.K. had never adopted the euro, preferring these many years to keep the pound sterling and its monetary independence. The year 2016 had been a relatively stable one for the USD/GBP rate, at least up until the Brexit vote on June 24, as shown in Exhibit D. The vote had a distinctly negative impact on the value of the pound. By August the pound sterling was down more than 12% against the dollar.

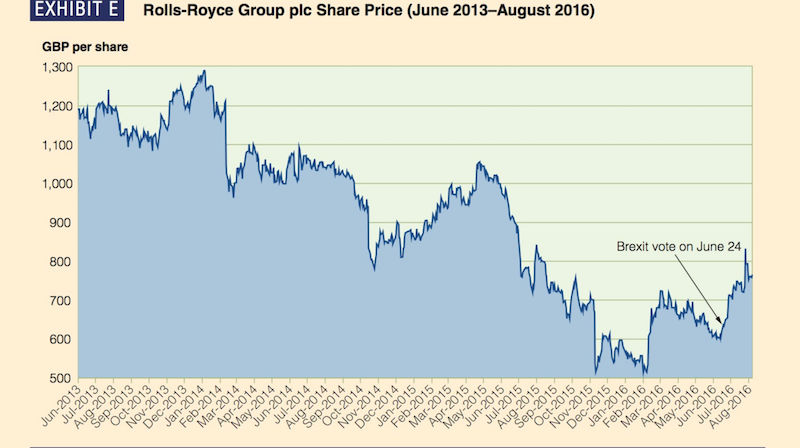

But a weaker pound was essentially good news for Rolls, as shown in its share price bump following the vote and its first-half year results (see Exhibit E).

Rolls was of the few companies whose shares rose on the day the referendum's result was announced, with analysts pointing out that the weaker pound made the export-reliant company's products cheaper, and therefore more competitive.

Posted just after the Brexit vote, Rolls' first half-year results had been in line with expectations, but expectations had been low. The slide of the pound against the dollar in late June, combined with the large forward contract hedge position, had forced the company to miss out on substantial currency gains. And that had led to the company recording a loss on its currency hedges. As one journalist explained:

Rolls-Royce is therefore still where it was pre-Brexit. What is actually being said here is that if Rolls-Royce didn't hedge then it would be ?2 billion better off today but it did hedge so it isn't.

In addition to exchange rate concerns, Brexit con-fronted Rolls-Royce with a number of very large long-term questions?questions about investment and strategy. Like other U.K. companies, Rolls was trying to decide whether or not to continue to invest in its operations and facilities in the U.K., or possibly redirect that invest to Continental Europe. No longer an EU member, U.K.-based companies now faced the possibility of being treated as outsiders to the Continental European markets, raising threats of trade restrictions, regulatory distinctions, and documentation requirements and delays.

Rolls-Royce said it has held "high-level" talks with minis-ten about the areas that it is keen to resolve after the Brex-it vote while the UK boss of Airbus said he did not want to deal with thousands of pages of documents and tariffs when dealing with his colleagues in mainland Europe.

Rolls itself continued to try and clarify to the market the outlook for its hedging program, a program now at more than $30 billion in notional principal?

Through our hedging activities we seek to reduce the volatility of our revenues, costs and resulting margins Our hedging instruments are sufficiently flexible to al-low us to achieve near 100% cover for our transactions in the short and medium term at close to our average hedge rate which stood at around $1.59 at the end of 2015. Over the longer term, should ?/$ remain at its current lower levels we should be able to add more hedges and achieve a lower average rate. With our hedge book now over $30 billion, the impact of lower ?/$ rafts will be limited in the near-term.

MINI-CASE QUESTIONS

1. Why do you think Rolls has continued to bear this structural currency mismatch so long? Why hasn't it done what many automobile companies have done, and move some of their manufacturing and assembly to the country in which the customer resides?

2. Why are Rolls-Royce's foreign currency hedges performing so poorly? Shouldn't the hedges be protecting its sales and earnings against exchange rate movements?

3. If you were a member of the leadership team at Rolls-Royce, what would you recommend the company do to manage the risks arising from Brexit?

EXHIBIT A Currency Structure of Rolls-Royce's Global Business Rolls-Royce's business was structurally mismatched by currency. Although global sales were dominated by the U.S. dollar, costs were still largely British pound-based. US dollar sales-$ European euro sales- British pound sales 75% 20% 5% Rolls-Royce (United Kingdom) 10% 30% 60% US dollar costs $ European euro costs British pound costs The result was a multinational company that was long U.S. dollars and short British pounds. If the U.S. dollar then appreciated versus the British pound, Rolls-Royce benefits. If, however, the dollar was to fall in value versus the pound, sales, earnings, and cash flows would fall in value as reported in British pounds. EXHIBIT B Derivative Financial Instruments Related to Foreign Exchange Risks At December 31, 2015 Currencies Sold Forward Sterling US dollar Euro Other At December 31, 2014 Currencies Sold Forward Sterling US dollar Euro Other Sterling (millions of ) 0 18,869 2 131 Sterling (millions of ) 0 16,659 150 167 US dollars (millions of ) 383 0 76 12 429 0 Currencies Purchased Forward Euro (millions of ) 0 1,552 0 143 US dollars (millions of ) 61 9 Currencies Purchased Forward Euro Other (millions of ) 221 902 125 2 (millions of ) 0 2,014 0 114 Other (millions of ) 199 938 185 10 Total (millions of ) 604 21,323 203 288 Total (millions of ) 628 19,611 396 300 EXHIBIT C Long-Term Exchange Rates of the Dollar, Euro, and Pound Currency units = 1.00 GBP 2.20 2.00 1.80 1.60 1.40 1.20 1.00 Jan-94 Nov-94 Sep-95 96-inr www. May-97 Mar-98 Jan-99 mik Nov-99 Sep-00 Jul-01 USD = 1.00 GBP May-02 Mar-03 EUR = 1.00 GBP Jan-04 Sep-05 Nov-04 Jul-06 momen Jan-09 May-07 Mar-08 www Nov-09 Sep-10 Jul-11 May-12 Mar-13 Jan-14 Nov-14 Sep-15 Jul-16 EXHIBIT D U.S. Dollars per British Pound Sterling in 2016 (USD = 1.00 STG, daily) 1.50 1.45 1.40 1.35 1.30 1.25 1/4/2016 1/11/2016 1/18/2016 1/25/2016 2/1/2016 2/8/2016 2/15/2016 2/22/2016 2/29/2016 3/7/2016 3/14/2016 3/21/2016 Date June 23 June 24 Aug 9 3/28/2016 USD to = 1.00 GBP 1.4801 1.3633 1.3009 % Change -7.89% -12.11% 4/11/2016 4/18/2016 4/25/2016 5/2/2016 5/9/2016 5/16/2016 5/23/2016 4/4/2016 5/30/2016 MA 6/6/2016 6/13/2016 Brexit Vote (June 24) 6/20/2016 Manon 6/27/2016 7/4/2016 7/11/2016 7/18/2016 7/25/2016 8/1/2016 8/8/2016 Jun-2013 Jul-2013 Aug-2013 500 Sep-2013 Oct-2013 Nov-2013 Dec-2013 Jan-2014 Feb-2014 Mar-2014 Apr-2014 May-2014 Jun-2014 Jul-2014 Aug-2014 Sep-20141 Oct-2014 Nov-2014 Dec-20141 Jul-2015 Jan-2015 Feb-2015 Mar-2015 Apr-2015 May-2015 Jun-2015 Oct-2015 Aug-2015 Sep-2015 Feb-2016 600 Nov-2015 Dec-2015 Jan-2016 Mar-2016 Apr-2016 May-2016 Jun-2016 Jul-2016 Aug-20161 700 800 Brexit vote on June 24 900 Mu 1,000 1,100 1,200 1,300 GBP per share EXHIBIT Rolls-Royce Group plc Share Price (June 3-August 2016)

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Certain financial institutions are ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started