Question

Carart Ltd is company established by the smash repair industry in Australia. Smash repairers fix and repair cars after they have been involved in an

Carart Ltd is company established by the smash repair industry in Australia. Smash repairers fix and repair cars after they have been involved in an accident. Most of the revenue of the smash repair business comes from a small number of insurance companies and car paint is their biggest cost. The industry is very fragmented, comprising many small businesses across Australia. Therefore, the individual smash repairer businesses had very little bargaining power either with the insurance companies or with their suppliers. In order to combat this, Carart Ltd was established and has the following aims;

- To act as a lobby group for the industry so that the individual smash repair business has a voice against suppliers, regulators and the insurance companies

- To negotiate better prices for the smash repairers for their paint and other supplies which they could not do individually due to their size

- To help build wealth for the individual smash repairer businesses through providing dividends from investments

- The income of Carart Ltd comprises rebate income from the paint suppliers as well as investment income. The rebate income is calculated as a fixed % of all the paint that each of the shareholder businesses acquire from the main paint supplier and is paid every July based on the paint costs of the prior financial year.

- Carart Ltd has a policy of paying out dividends annually to the shareholders

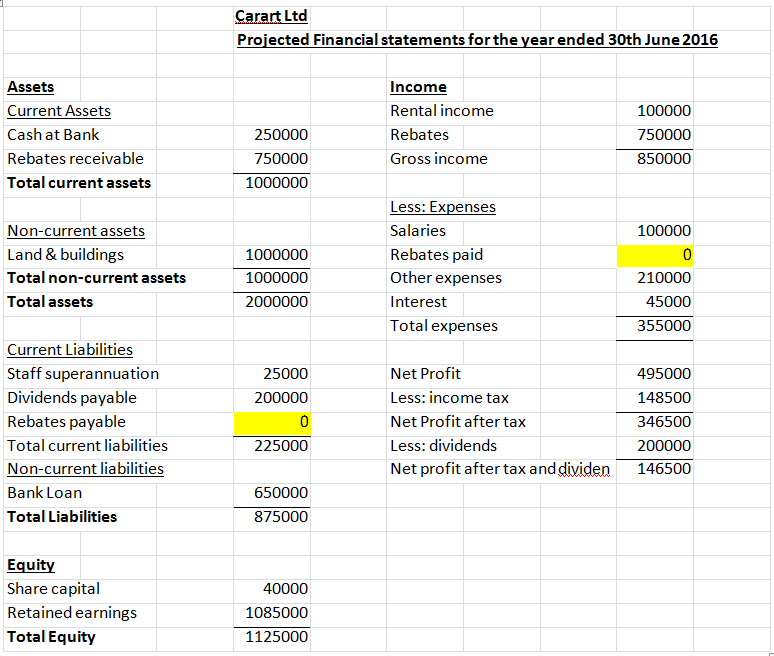

- A copy of the draft projected financial statements for Carart Ltd is provided

- Carart Ltd has recently acquired a commercial rental property with bank funding. The building cost $1m and they borrowed $650000. As a result of the funding, the bank has imposed the following debt covenant;

- Net profit margin of at least 30% (EBIT/gross income)

Scenario and decision

The board is having their final board meeting before 30 June 2016 and Nicole has advised them that one of the shareholders has contributed well over half of the rebate income for the year. The board is considering rewarding this shareholder by paying out a rebate to them of $300,000 specifically as a bonus for their efforts. This would be accounted for as an additional expense of Carart Ltd but it would mean that it is fairer for that shareholder given their contribution.The board is trying to decide whether or not they should commit to this before or after 30 June as they are conscious of the impact this payment would have on the other stakeholders of Carart Ltd, especially the bank.

Nicole has sought your advice as the external accountant to Carart Ltd.

REQUIRED

You are required to write a Letter of Advice to the Board, together with a transmittal email to Nicole outlining

- The financial impact that declaring the rebate before or after 30 June will have (calculations are required)

- Whether or not this represents earnings management, and if it is good or bad earnings management? (academic references required)

- Your recommendation as to which year the rebate should be committed to pre or post 30 June. (Hint: you may want to consider the AAA model discussed in the lecture)

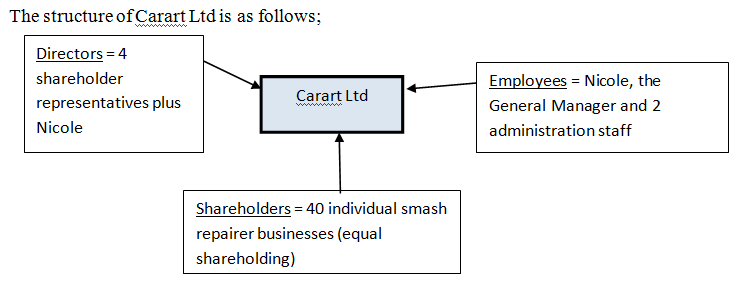

The structure of Carart Ltd is as follows; Directors = 4 shareholder representatives plus Nicole Carart Ltd Shareholders = 40 individual smash repairer businesses (equal shareholding) Employees = Nicole, the General Manager and 2 administration staff Assets Current Assets Cash at Bank Rebates receivable Total current assets Non-current assets Land & buildings Total non-current assets Total assets Current Liabilities Staff superannuation Dividends payable Rebates payable Total current liabilities Non-current liabilities Bank Loan Total Liabilities Equity Share capital Retained earnings Total Equity Carart Ltd Projected Financial statements for the year ended 30th June 2016 250000 750000 1000000 1000000 1000000 2000000 25000 200000 0 225000 650000 875000 40000 1085000 1125000 Income Rental income Rebates Gross income Less: Expenses Salaries Rebates paid Other expenses Interest Total expenses Net Profit Less: income tax Net Profit after tax Less: dividends Net profit after tax and dividen 100000 750000 850000 100000 0 210000 45000 355000 495000 148500 346500 200000 146500

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The Accounting Theory and Analysis DrLeakey Director Leakey Consultants November 252016 Advice Board of Directors Subject Impact of rebate declaration Purpose Based on the payment made on the rebate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started