Question

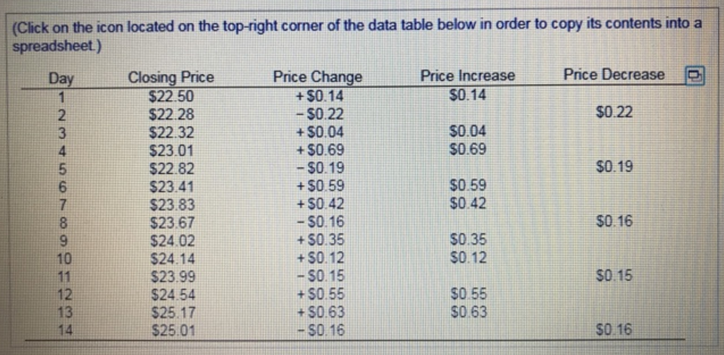

Data on a stock's closing price and its price change for the last 14 trading days appears in this table. a. Over this 14-day period,

Data on a stock's closing price and its price change for the last 14 trading days appears in this table.

a. Over this 14-day period, what is the average gain on up days? (Note to calculate the average; divide the sum of all gains by 14, not the number of days on which the stock went up)

b. Over this 14-day period, what is the average loss on down days?

c. What is the RSI?

d. Is the RSI sending a strong buy or sell signal?

a. Over this 14-day period, the average price change on up days is $..... (Round to three decimal places)

b. Over this 14-day period, the average price change on down days $..... (Round to three decimal places)

c. The relative strength index (RSI) is $..... (Round to the nearest whole number)

d. Is the RSi sending a strong buy or sell signal? (Select the best choice below)

A. Values below 30 suggest that a stock is oversold, a buy signal Values above 70 suggest that a stock is overbought, a sell signal. In this case, the RSI is sending a strong sell signal.

B. Values below 30 suggest that a stock is overbought, a sell signal Values above 70 suggest that a stock is oversold, a buy signal. In this case, the RSl is sending a strong buy signal.

C. Values below 30 suggest that a stock is oversold, a sell signal. Values above 70 suggest that a stock is overbought a buy signal. In this case, the RSI is sending a strong buy signal.

D Values below 30 suggest that a stock verbought, a buy s al Values above 70 suggest at a stock s oversold a se s nal In his case the RSI s sending a strong sell signal.

(Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Day 1 2 3 4 5 6 7 8 9 01734 11 12 Closing Price $22.50 $22.28 $22.32 $23.01 $22.82 $23.41 $23.83 $23.67 $24.02 $24.14 $23.99 $24.54 $25.17 $25.01 Price Change + $0.14 - $0.22 + $0.04 + $0.69 - $0.19 + $0.59 + $0.42 -$0.16 + $0.35 + $0.12 - $0.15 + $0.55 + $0.63 $0.16 Price Increase $0.14 $0.04 $0.69 $0.59 $0.42 $0.35 $0.12 $0.55 $0.63 Price Decrease $0.22 $0.19 $0.16 $0.15 $0.16 n

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The relative strength index RSI is a momentum indicator that measures the magnitude of recent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started