Question

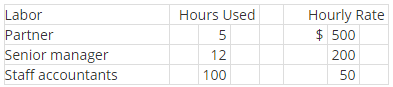

Diaz and Associates incurred the following costs in completing a tax return for a large company. Diaz applies overhead at 50% of direct labor cost.

Diaz and Associates incurred the following costs in completing a tax return for a large company. Diaz applies overhead at 50% of direct labor cost.

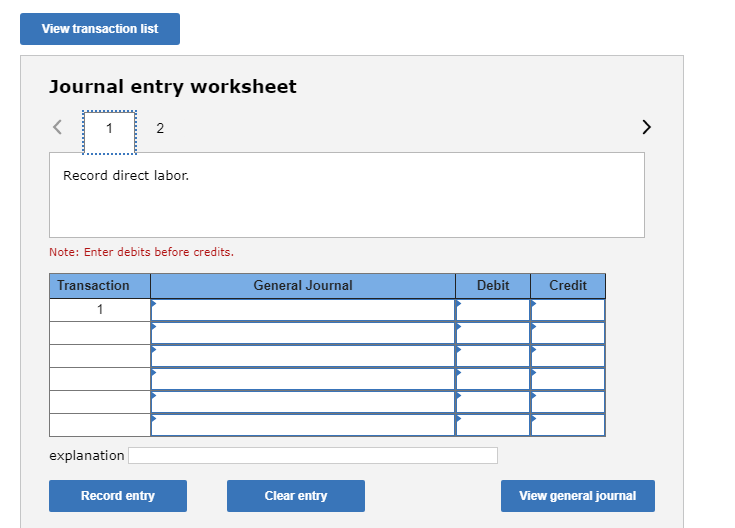

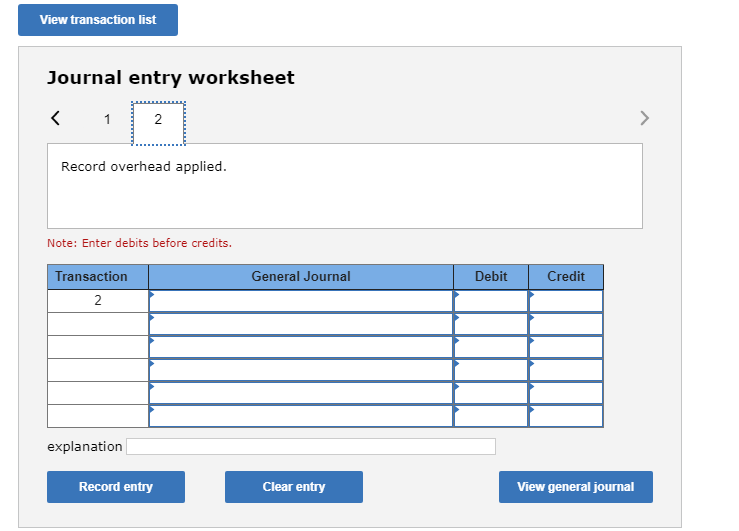

Prepare journal entries to record direct labor and the overhead applied.

Labor Partner Senior manager Staff accountants Hours Used 5 12 100 Hourly Rate $ 500 200 50 View transaction list Journal entry worksheet C Record direct labor. Note: Enter debits before credits. Transaction 1 2 explanation Record entry General Journal Clear entry Debit Credit View general journal > View transaction list Journal entry worksheet 1 Record overhead applied. 2 Note: Enter debits before credits. Transaction 2 explanation Record entry General Journal Clear entry Debit Credit View general journal >

Step by Step Solution

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J Wild, Ken Shaw

24th edition

1259916960, 978-1259916960

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App