Diaz and Associates incurred the following costs in completing a tax return for a large company. Diaz

Question:

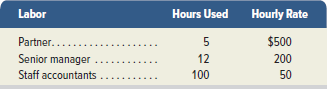

Diaz and Associates incurred the following costs in completing a tax return for a large company. Diaz applies overhead at50% of direct labor cost.

1. Prepare journal entries to record direct labor and the overhead applied.

2. Prepare the journal entry to record the cost of services provided. Assume the beginning Services in Process Inventory accounthas a zero balance.

Hourly Rate Labor Hours Used Partner... Senior manager Staff accountants 5 12 100 $500 200 50

Step by Step Answer:

1 Services in Process Inventory 9900 Service Salaries Paya...View the full answer

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Apples and Googles income statements in Appendix A both show increasing sales and cost of sales. Thegross margin ratio can be used to analyze how well companies control costs as sales increase....

-

Refer to the information in Exercise 21-16. 1. Assume Hudson Co. has a target pretax income of $162,000 for 2020. What amount of sales (in dollars) is needed to produce this target income? 2. If...

-

Apple offers extended service contracts that provide repair coverage for its products. Assume Apple charges$160 to repair an iPhone screen and $400 for other repairs. Services are provided in a ratio...

-

Prepare a statement of profit or loss and other comprehensive income( year ending 31 march 2023) , and a statement of financial position as at 31 march 2023 for the Batliss Plc Bayliss Plc is a...

-

Show that, for SHM, the maximum displacement, velocity, and acceleration are related by v2m = amA?

-

Do mosses have an alternation of isomorphic or heteromorphic generations? That is, can you easily tell a moss gametophyte from a moss sporophyte? When we look at leafy green moss plants, what are we...

-

Part 1. Craig, Cook, and Chan are partners and share income and loss in a 5:1:4 ratio. The partnerships capital balances are as follows: Craig, $606,000; Cook, $148,000; and Chan, $446,000. Craig...

-

Watkins, Inc., has experienced an explosion in demand for its ram football novelties. The firm currently (time 0) pays a dividend of $0.50 per share. This dividend is expected to increase to $1.00...

-

Allocating Joint Costs Using the Physical Units Method Orchard Fresh, Inc., purchases apples from local orchards and sorts them into four categories. Grade A are large blemish-free apples that can be...

-

On May 15, 201X, Ramon Co. gave Silver Co. a 180-day, $14,000, 10% note. On July 14, Silver Co. discounted the note at 12%. 1. Journalize the entry for Silver to record the proceeds. 2. Record the...

-

EcoSkate makes skateboards from recycled plastic. For a recent job lot of 100 skateboards, the company incurred direct materials costs of $600 and direct labor costs of $200. Overhead is applied...

-

Apple and Samsung compete in the global marketplace. Apples and Samsungs financial statements are in Appendix A. Required 1. Compute the ratio of inventory to total assets for Apple as of September...

-

The Lowensohn Company is preparing a cash receipts schedule for the first quarter of 2005. Sales on account for November and December 2004 are expected to be \($320,000\) and \($550,000\),...

-

Problem 1 PROBLEMS Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31, provides you with the following data concerning its tax accounts and capital...

-

9.6. A habitual gambler often visits three different casinos and plays roulette there. He wants to discover at which casino he has better luck with his roulette games. So, he records his gambling...

-

The firm has estimated that its sales for 2 0 1 3 will be $ 8 4 6 , 7 5 6 Cash dividends to be paid by the firm in 2 0 1 3 $ 3 7 , 7 2 0 Minimum cash balance to be maintained by the firm $ 2 8 , 5 1...

-

Bob Long was hired by County Hospital aS supervisor of engineering and maintenance. Although well experienced in his field, this was his first management job. Soon after Bob's arrival a maintenance...

-

Initial Outlay (IO) 1. A company is considering purchasing a machine for $100,000. Shipping costs would be another $5,000. The project would require an initial investment in net working capital of...

-

In Problem use the given annual interest rate r and the compounding period to find i, the interest rate per compounding period. 6.6% compounded quarterly

-

In muscle tissue, the ratio of phosphorylase a to phosphorylase b determines the rate of conversion of glycogen to glucose 1phosphate. Classify how each event affects the rate of glycogen breakdown...

-

Volvo Group reports the following information for its product warranty costs as of December 31, 2008, along with provisions and utilizations of warranty liabilities for the year ended December 31,...

-

The following monthly data are taken from Nunez Company at July 31: Sales salaries, $120,000; Office salaries, $60,000; Federal income taxes withheld, $45,000; State income taxes withheld, $10,000;...

-

Madison Company has nine employees. FICA Social Security taxes are 6.2% of the first $106,800 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.8% and SUTA taxes...

-

A government bond matures in 30 years, makes semi-annual coupon payments of 6.0% ($120 per year) and offers a yield of 3.7% annually compounded. Assume face value is $1,000. Three years later the...

-

Your objective is: 1. Carry out a life insurance needs analysis, for each one of them (show your calculations) [30 Marks] 2. Refer to the case and the insurance plan quotes. Would you recommend...

-

TufStuff, Incorporated, sells a wide range of drums, bins, boxes, and other containers that are used in the chemical industry. One of the company s products is a heavy - duty corrosion - resistant...

Study smarter with the SolutionInn App