Question

During a maternity leave of the full-time bookkeeper at a privately owned furniture repair business, a temporary employee was involved in the following transactions. 1.

During a maternity leave of the full-time bookkeeper at a privately owned furniture repair business, a temporary employee was involved in the following transactions.

1. Work was completed on the order for one of the customers who had paid the full price in advance of $550 several months ago. At that time it was recorded as unearned revenue. The journal entry to record completing the work was a debit to Cash and a credit to Service Revenue.

2. A cheque in the amount of $1,030 was received in payment of a customer's account: Accounts Receivable was debited and Cash was credited.

3. Prepaid insurance for $500 was paid by cheque. The resulting entry included a debit to Prepaid Insurance and a credit to Insurance Expense for $500.

4. 10 cartridges of printer toner were purchased on account for $600. This transaction was recorded as a debit to Equipment and a credit to Accounts Payable. None of the cartridges has been used.

5. Interest for one month on a $6,800 note payable was accrued as a debit to Interest Expense and credit to Interest Payable for 86.80. The annual rate of interest is 10%.

6. When the owner, L. Lowe, used $1,060 cash for personal expenses, a debit was made to L. Lowe, Capital and a credit was made to Cash.

7. Equipment costing $380 was purchased on account. This was recorded with a debit to Repairs Expense and a credit to Cash.

8. The business was approved for a bank loan of $520 to be paid in five equal installments over the next five months. No entry was recorded.

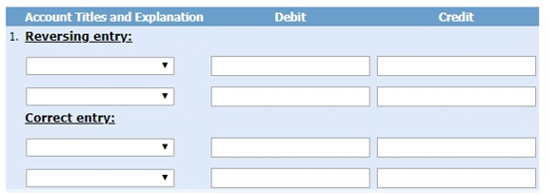

Correct each error by reversing the incorrect entry and then recording the correct entry. (Round answers to 0 decimal pokes, e.g. 5,270. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)

Account Titles and Explanation 1. Reversing entry: Correct entry: Debit Credit

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Rever...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609ac3a72dbbf_30963.pdf

180 KBs PDF File

609ac3a72dbbf_30963.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started