Question

Evaluate the American Creations proposal on behalf of Bellingham plc, supporting your arguments with relevant theory and calculations and indicating any non-financial matters you feel

Evaluate the American Creations proposal on behalf of Bellingham plc, supporting your arguments with relevant theory and calculations and indicating any non-financial matters you feel should be taken into consideration.

Your report should consider the following areas:

1. An analysis of Bellingham's current position using relevant financial ratios. You should show the calculation of the ratios and provide interpretation of the results.

2. Calculation of Bellingham's cost of capital, using alternative methods and arriving at the most appropriate figure.

3. An investment appraisal of the American Creations proposal assuming the valuation suggested in the case, using a variety of methods and evaluation of the results.

4. A sensitivity analysis of the proposal and interpretation of the results.

5. Calculation and discussion of alternative valuations for acquiring the share in American Creations and how these would impact on the investment appraisal.

6. A discussion of the various available methods of financing the acquisition and consideration of which is the most appropriate.

Your calculations and arguments should be supported by relevant theory, with evidence of wide reading around the subject.

You should provide a complete bibliography with appropriate referencing in your report.

Arthur Scroggs was a farmer. His family has owned and farmed 500 acres of prime land in the Vale of Aylesbury for four generations. In the mid 1980's small farms were finding the financial climate difficult with falling farm incomes and much talk of putting farm land to "alternative use". By 1985 Arthur had already sold his dairy herd to focus on cereal production when a fortuitous meeting with Lucy Bellingham at a business conference led him to reconsider the future of the family farm. Bellingham is a designer of bespoke fitted kitchens who had a business plan but little capital. The plan was to manufacture top quality fitted kitchen furniture and establish design studios/showrooms in high income areas. Having recently sold his dairy herd, Arthur had enough capital to fund the new business and also a number of large barns and outbuildings suitable for manufacturing the kitchen units subject to refitting and planning consent being obtained. Lucy's business plan was so convincing that Arthur decided to get out of farming altogether (by leasing his arable land to a local cooperative) and focus on developing the new business. From this small beginning grew the now publicly quoted company of Bellingham plc.

Initially, showrooms were established in Beaconsfield and then Kensington. Demand for their kitchens was brisk and ?Bellingham Bespoke Kitchens? expanded rapidly but remained a partnership. The firm?s clients are mainly celebrities from the entertainment world and the cost of a Bellingham Bespoke Kitchen is now ?40,000 - ?150,000 or more. The firm was restructured as a limited company in 1990 and subsequently experienced rapid growth until 1999.

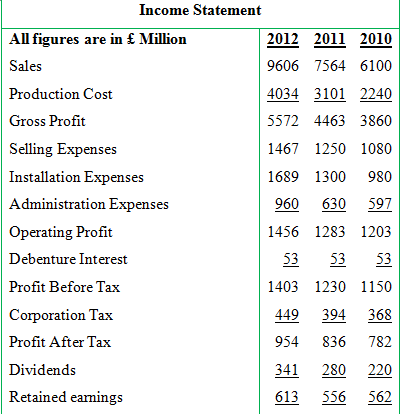

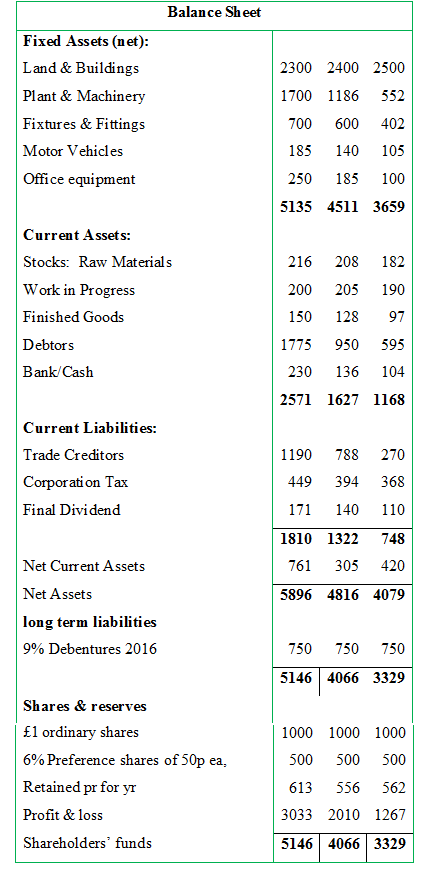

Income Statement All figures are in Million Sales Production Cost Gross Profit Selling Expenses Installation Expenses Administration Expenses Operating Profit Debenture Interest Profit Before Tax Corporation Tax Profit After Tax Dividends Retained earnings 2012 2011 2010 9606 7564 6100 4034 3101 2240 5572 4463 3860 1467 1250 1080 1689 1300 980 960 630 597 1456 1283 1203 53 53 53 1403 1230 1150 449 394 368 954 836 782 280 220 556 562 341 613 Fixed Assets (net): Land & Buildings Plant & Machinery Fixtures & Fittings Motor Vehicles Office equipment Current Assets: Stocks: Raw Materials Work in Progress Finished Goods Debtors Bank/Cash Current Liabilities: Trade Creditors Corporation Tax Final Dividend Balance Sheet Net Current Assets Net Assets long term liabilities 9% Debentures 2016 Shares & reserves 1 ordinary shares 6% Preference shares of 50p ea, Retained pr for yr Profit & loss Shareholders funds 2300 2400 2500 1700 1186 552 700 600 402 185 140 105 250 185 100 5135 4511 3659 216 208 182 200 205 190 150 128 97 1775 950 595 230 136 104 2571 1627 1168 1190 788 270 449 394 368 171 140 110 1810 1322 748 761 305 420 5896 4816 4079 750 750 750 5146 4066 3329 1000 1000 1000 500 500 500 613 556 562 3033 2010 1267 5146 4066 3329

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Investment Appraisal Sales 2013 2014 2015 2016 2017 Revenue from Operation...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started