Ferris Company has an old machine that is fully depreciated but has a current salvage value of $5,000. The company wants to purchase a new

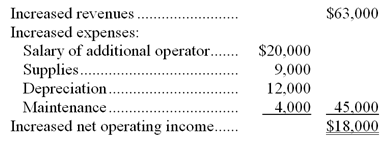

Ferris Company has an old machine that is fully depreciated but has a current salvage value of $5,000. The company wants to purchase a new machine which would cost $60,000 and have a 5-year useful life and zero salvage value. Expected changes in annual revenues and expenses if the new machine is purchased are:

Required:

1. Compute the payback period on the new equipment.

2. Compute the simple rate of return on the new equipment.

Increased revenues........ Increased expenses: Salary of additional operator......... $20,000 Supplies...... 9,000 Depreciation..... 12,000 Maintenance..... 4.000 Increased net operating income....... $63,000 45,000 $18.000

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Payback Period Payback Period 333 2 Cost of machin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started