Question

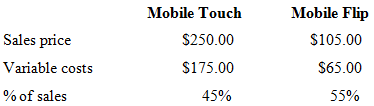

Hughes Inc. sells two different types of mobile phones. The following data is available for these two products. The company has total annual fixed costs

Hughes Inc. sells two different types of mobile phones. The following data is available for these two products.

The company has total annual fixed costs of $1,115,000 per year. The tax rate for the company is 30%

Requirements:

A. Calculate the number of total phones that Hughes Inc. needs to sell in order to break-even.

B. Calculate the number of each phone that Hughes Inc. needs to sell in order to break-even.

C. Calculate the number of each phone that Hughes Inc. needs to sell in order to earn a pre-tax net operating income of $200,000

D. Calculate the number of total phones that Hughes Inc. needs to sell in order to earn a after-tax net operating income of $175,000

Sales price Variable costs % of sales Mobile Touch $250.00 $175.00 45% Mobile Flip $105.00 $65.00 55%

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

A Mobile Touch Mobile Flip Sales Price 250 105 Variable costs 175 65 Contrib...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Business Analytics

Authors: Cliff Ragsdale

7th Edition

1285418689, 978-1285969701, 1285969707, 978-1285418681

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App