Question

IBM and GE are both in the market for approximately $30 million of debt for a five year-period. GE has an AAA credit rating while

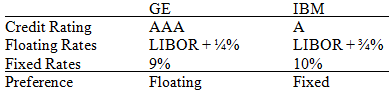

IBM and GE are both in the market for approximately $30 million of debt for a five year-period. GE has an AAA credit rating while IBM has a single A rating. GE has access to both fixed and floating interest rate debt at attractive rates. However, GE would prefer to borrow at floating rates. Although IBM can borrow at both interest rates, the fixed rate debt is considered expensive. IBM would prefer to borrow at fixed rates. The information about the two firms is summarized as follows:

Please answer the following questions:

1. In what type of borrowing does IBM have the comparative advantage? Why?

2. In what type of borrowing does GE have the comparative advantage? Why?

3. If a swap were arranged, what is the maximum savings that could be divided between the two parties?

4. Please arrange such a swap so that the total savings are divided evenly between the two parties. Please use arrows and boxes to illustrate the deal.

Credit Rating Floating Rates Fixed Rates Preference GE AAA LIBOR +4% 9% Floating IBM A LIBOR +% 10% Fixed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 In this example IBM has long term borrowing advantage as compared to GE With the preferred fixed borrowing interest rate it means that the amount bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started