Question

In 1970 a European consortium consisting of Germany, France, and the UK (Spain later became a member) created Airbus Industrie. The objective of the consortium

In 1970 a European consortium consisting of Germany, France, and the UK (Spain later became a member) created Airbus Industrie. The objective of the consortium was to build commercial aircraft with Germany, the UK and Spain taking on the job of constructing the aircraft and France assuming responsibility for assembling it. The logic of the arrangement was fairly straightforward Given the growth of international travel, there would be a continual need for new commercial aircraft, and Airbus wanted to be a major player in this industry.

When major air carriers such as American Airlines, Japan Airlines, and Lufthansa needed to replace aging aircraft or increase the size of their fleet they turned to Boeing or McDonnell Douglas, the two giant US aircraft manufacturers. Cargo carriers such as FedEx and DHL also bought aircraftfrom them, and as international air shipments continued to growrapidly, the annual demandproved to be a boon for Boeing and McDonnell.

The initial challenge for Airbus was to capture some market share and thus establish a toehold in the industry. This was not a problem. The consortium had divided up the responsibility for building the aircraft among its members. In this way, each country was guaranteed some of the work and in turn, could count on its respective government to provide financial assistance and contracts. In particular, the consortium would have to spend large amounts of money for research and development in order to build competitive, state-of-the-art craft, but by getting support from their respective governments a great deal of the initial risk would be eliminated This, by the way, was the same approach that had been used in the United States and helped account for much of Boeing's and McDonnell's success in building large aircraft. For example, much of the funding to build the giant C-SA cargo plane was provided by the US military. Then, by using this same technology, it was possible for Boeing to buil d its gantpassenger aircraft.

Realizing that the consortium would eventually be able to build competitive craft, Boeing and McDonnell lodged complaints with the US government claiming that the European governments were subsidizing Airbus, and Washington needed to take steps to protect the US commercial aircraft manufacturing industry. As the governments on both sides met to talk and discuss these issues, Airbus started building aircraft. It took quite a while, but by 1990 the consortium not only was becoming well established but also had back orders for 1,100 aircraft and by 1997 this number had reached 2,300. In the process Airbus captured over 30 percent of the world market. One of the major reasons for its success was that it focused on building fuel-efficient craft at competitive prices. Its wide-body, medium-range models, the MOO andA310, for example, were very reliable and the orders started flowing in from a wide number of buyers induding large US carriers such as American Airlines and Northwest. During the 1990s the battle in the aircraft market also saw Boeing and McDonnell Douglas merge their operations. McDonnell could not compete effectively in this new highly competitive market but when merged with Boeing it could provide the company with a good chance to prevent Airbus from completely taking over the US aira-aft manufacturing industry.

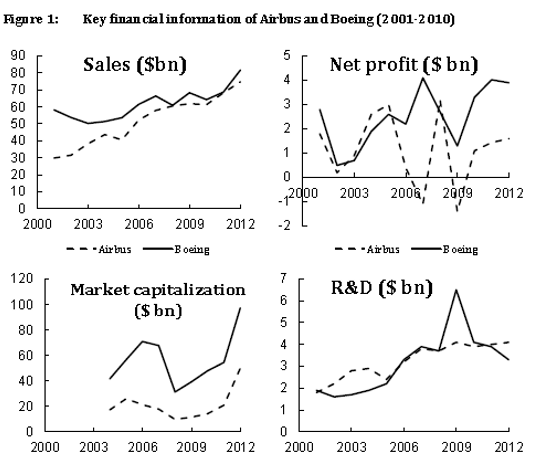

Figure 1 presents the key financial information of Airbus and Boeing for the period 2001- 2010. At the turn of the century, Boeing was twice as large as Airbus in terms of sales. However, Airbus has managed to catch up in the last ten years. Boeing has been more profitable. Boeing's net profits were on average 5.7% of sales, whereas Airbus' net profits only 2.6% of sales. Furthermore, the volatility of Airbus's net profits seems to be higher than of Boeing. These differences in profitability are reflected in the market capitalization of both companies. Boeing is in terms of market capitalization almost three times as large as Airbus. Industry analysts are also more optimistic about Boeing than Airbus. They expect that Boeing will grow its sales by 9% a year up to 2014 whereas they expect a growth of 6% a yearforAirbus (source: Orbis).

By 2010, Airbus was doing better than ever. Not only had it managed to catchup with Boeing and hold 50 percent of the overall market, but it was making major decisions that could result in its becoming the dominant player in the industry. The company had decided to build a giant double-decker superjumbo jet Known as the A380, this aircraft is capable of carrying 555 passengers, and the first craft made its first commercial flight in 2007. A large number of buyers signed firm orders with the company, including Qantas which ordered 12 of the craft Singapore Airlines, and Air Prance, which each placed orders for 10. In addition Singapore Airlines took an option for 15 more. The Singapore deal alone was worth over $8 billion to Airbus, showing how lucrative the market fora superjumbo jet could be.

In response, Boeing announced that it was going to build the 787 Drearaliner: a smaller, faster, longer-range plane that would fly just below the speed of sound. The main advantage of this type of aircraft is that it would enable airline companies to take their passengers to their final destination directly, rather than through a hub-and-spoke system with several transfers and connecting flights, as would be the case with the A380. Boeing's decision to abandon the development of a larger plane (similar to what Airbus proposed) relied heavily on follow-up studies of the giant 747. The company's engineers concluded that, except in the case of a huge 800-passenger plane, a double-decker design hadto be scaled back to a single decker to satisfy technical and safety standards. One reason, ac cording to Boeing's engineers, is because a double-decker arrangement is very inefficient. Another is that, in case of evacuation, a two-level aircraft can present major problems for those on board. So, Boeing pursued their strategy of developing a smaller, longer-range aircraft. The Dreamliner's first commercial flight was in October 2011, with several airlines placing large orders for this new aircraft.

Quite dearly, the two competitors were moving in different directions. Airbus is betting more than $12 billion in research and development expenditures that airlines want a superjumbo jet that can carry a large number of passengers on long trips to a given region. Boeing is betting that there is a much larger demand for smaller, faster planes that can take people directly to their destination In doing so, Boeing has ceded to Airbus a highly profitable jumbo market, wagering that the European group will not earn back its huge investment but rather end up stumbling badly.

Meanwhile, Airbus andB oeing's customers, the airlines, are not doingwell. The International Air Transport Asso nation (IATA) downgraded its 2011 airline industry profit forecast to $4 billion, This would be a 78% drop comparedwith the $18 billionnet profit recorded in 2010. On expected revenues of $598 billion, a $4 billion profit equates to a 0.7% margin. 'Natural disasters in Japan, unrest in the Middle East andNorth Africa, plus the sharp rise in oil prices have slashed industry profit expectations to $4 billion this year. That we are making any money at all in a year with this combination of unprecedented shocks is a result of a yery fragile balance. The efficiency gains of the last decade and the strengthening global economic environment are balancing the high price of fuel. But with a dismal 0.7% margin, there is little buffer left against further shocks." according to Giovanni Bisignani, IATA's Director General and CE0.2

Will Airbus dominate the airways? Its initial challenge was to build the A380 superjumbo. If the demand for the large aircraft continues Boeing may find itself as a minor player in the industry. On the other hand, while in late 2001 Airbus recruited thousands of new partners to help with the project, it had trouble finding partners to help fund the venture. A number of European suppliers signed up but US and Japanese companies did not. For example, Airbus had offered Japanese manufacturers up to 8 percent of the work on the A300 in return for funding but had no takers The company also wanted to get US firms to invest and thus defuse a potential political problem that could result in the US government making it difficult for Airbus to do business in the United States. When Airbus first got started, it relied heavily on governmental support. Now that it is very successful, it no longer needs this type of help. However, the US government is unlikely to sit by and let Airbus dominate the industry and force Boeing out of its leadership position. In a way, the situation is similar to that in 1970 -the main difference perhaps is that the two companies now seem to be in opposite positions, with Boeing being more in need of government support than Airbus.

Economics practical

In this assignment, you will act as the competition authority to determine whether there is ?false competition?, that is, you will investigate whether Airbus and Boeing have formed agreements.

To d0 so, you need information about the market for air travel. An econornetrician has extirpated that the dernand for airplanes, Q, can be represented by the following dernand equation:

Figure 1: 90 80 70 60 50 40 30 20 10 0 2000 120 100 80 60 40 20 0 2000 Key financial information of Airbus and Boeing (2001-2010) Sales ($bn) Net profit ($bn) Market capitalization ($bn) 5 4 2003 2006 2009 2012 3 2 2003 2006 2009 2012 -2 ---Airbus Boeing 0 -12000 7 6 2003 2006, 2009 -Airbus R&D ($bn) 5 4 3 2 1 0 2000 2003 2006 Boeing 2012 A 2009 2012

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Strengths Market Share Airbus enjoyed a 57 market share in the year 2015 growing from 505 in the previous year outstanding its major competitor Boei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609a2cd6307ed_30354.pdf

180 KBs PDF File

609a2cd6307ed_30354.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started