Question

In 1998, the Syndicated Bank Loan market (defined as loans having more than two bank lenders) was a vast and cheap source of debt financing

In 1998, the Syndicated Bank Loan market (defined as loans having more than two bank lenders) was a vast and cheap source of debt financing for U.S. corporations. This market was characterized by a large number of financial institutions that aggressively committed capital to debt issuers as a way to build market share and increase earnings.

Over the next three years, however, syndicated loan prices increased dramatically while the quantity of these loans declined. The price increase, measured as a markup over the cost of funds or LIBOR (London Interbank Offered Rate), is illustrated in the figure labeled ? All-In

Drawn Pricing. ? For example, the price to BBBrated companies rose from 37.5 basis points in 1998 to approximately 129 basis points in 2002. This is a 244% increase in the price or spread.

Explain these changes using shifts in demand and/or supply.

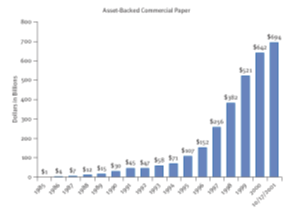

Over the same time period, in a related lending market, asset-backed commercial paper, we see a huge quantity increase as shown in the ? Asset-Backed Commercial Paper ? graph.

Over the same time period, in a related lending market, asset-backed commercial paper, we see a huge quantity increase as shown in the ? Asset-Backed Commercial Paper ? graph.

Did prices for these loans increase or decrease? Justify your answer using/reviewing shifts in supply and demand curves.

110 108 All-inDrawn Pricing including Usage fees) 1099 -300-800-100- 1000 Q 3001 1Q02 8/12/2002 Dollars in Bios 700 AssBacked Commercial Paper SS SS Se Say Sya 54647

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Managerial Economics Demand and Supply The condition that Syndicated Banks Loans went through can be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60981eae69bf8_28520.pdf

180 KBs PDF File

60981eae69bf8_28520.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started