Maria Garza?s regular hourly wage rate is $15.00, and she receives a wage of 1.5 times the regular hourly rate for work in excess of

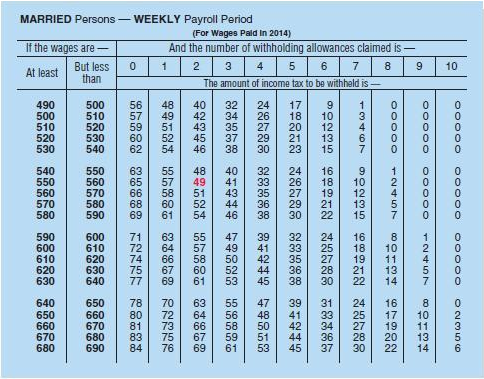

Maria Garza?s regular hourly wage rate is $15.00, and she receives a wage of 1.5 times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period, Maria worked 42 hours. Her gross earnings prior to the current week were $6,000. Maria is married and claims three withholding allowances. Her only voluntary deduction is for group hospitalization insurance at $28.00 per week.

Compute the following amounts for Maria?s wages for the current week.

Record Maria?s pay.

(1) Gross earnings

(2) FICA taxes

(3) Federal income taxes withheld

(4) State income taxes withheld

(5) Net pay

10 9 8 7 6 And the number of withholding allowances claimed is- of income tax to be withheld is 5 4 (For Wages Paid In 2014) Payroll Period amount 3 2 MARRIED Persons-WEEKLY But less If the wages are At least 1 0 The than 00000 00000 02356 00000 00000 810 1 18 00000 12457 801184 167 19 20 22 13467 9102315 168192122 24 25 27 28 30 9 10 12 19 1568192122 242527 2830 31 33 34 38 37 7 18 20 21 23 24 25 27 29 30 32 33 25 26 38 39 44 42 4 45 24 25 27 29 30 32 38 35 36 38 38 44 44 4547 48 50 58 32 34 35 37 38 40 4454 45 749 50 52 53 55 56 58 59 40 42 45 45 4648 49 1 52 54 55 58 60 61 666 7 69 48 49 51 52 555 786 3466 70 75 56 7 59 60 6263 65686 172 74 757 80 500 510 520 530 540 550 560 570 580 590 12457 61 069

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Gross earnings 645 2 FI...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started