Question

Multiple choice questions: 1) Sales volume variance is the difference between the: A) Actual amounts and the flexible budget due to differences in price and

Multiple choice questions:

1) Sales volume variance is the difference between the:

A) Actual amounts and the flexible budget due to differences in price and costs.

B) Expected results in the flexible budget for the actual units sold and the static budget.

C) Static budget and actual amounts due to differences in selling price.

D) Flexible budget and static budget due to differences in fixed costs.

2) Flexible budget variance is the difference between the:

A) Actual results and the expected results in the flexible budget for the actual units sold.

B) Expected results in the flexible budget for the units expected to be sold and the static budget.

C) Flexible budget and actual amounts due to differences in volumes.

D) Flexible budget and static budget due to differences in fixed costs.

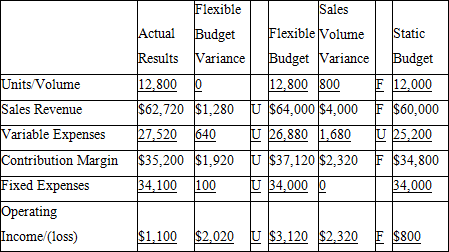

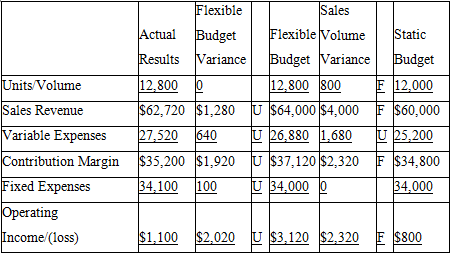

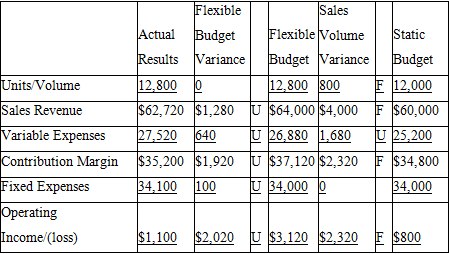

3) The Carolina Products Company has completed the flexible budget analysis for the 2nod quarter, which is as given below.

Which of the following would be a correct interpretation of the sales volume variance for sales revenues?

A) Increase in price per unit

B) Increase in sales volume

C) Increase in variable expense per unit

D) Increase in fixed costs

4) The Carolina Products Company has completed the flexible budget analysis for the 2nod quarter, which is as given below.

Which of the following would be a correct interpretation of the sales volume variance for variable expenses?

A) Decrease in price per unit

B) Increase in variable cost per unit

C) Increase in sales volume

D) Increase in fixed costs

5) The Carolina Products Company has completed the flexible budget analysis for the 2nod quarter, which is as given below.

Which of the following statements would be a correct interpretation of the sales volume variance for operating income?

A) Decrease in price per unit

B) Increase in variable cost per unit

C) Increase in sales volume

D) Increase in fixed costs

Units/Volume Sales Revenue Variable Expenses Contribution Margin Fixed Expenses Operating Income/(loss) Flexible Actual Budget Results Variance 12,800 0 $62,720 $1,280 U $64,000 $4,000 27,520 640 U 26,880 1,680 $35,200 $1,920 34,100 100 U 34,000 0 Sales Flexible Volume Budget Variance 12,800 800 U $37,120 $2,320 Static Budget E 12,000 F $60,000 U 25,200 F $34,800 34,000 $1,100 $2,020 $3,120 $2,320 E $800 Units/Volume Sales Revenue Variable Expenses Contribution Margin Fixed Expenses Operating Income/(loss) Flexible Sales Actual Budget Flexible Volume Results Variance Budget Variance 12,800 0 12,800 800 $62,720 $1,280 U $64,000 $4,000 27,520 640 U 26,880 1,680 $35,200 $1,920 U $37,120 $2,320 34,100 100 U 34,000 0 Static Budget E 12,000 F $60,000 U 25,200 F $34,800 34,000 $1,100 $2,020 U $3,120 $2,320 F $800 Units/Volume Sales Revenue Variable Expenses Contribution Margin Fixed Expenses Operating Income/(loss) Flexible Actual Budget Results Variance Sales Flexible Volume Static Budget Variance Budget 12,800 800 F 12,000 F $60,000 U 26,880 1,680 U 25,200 F $34,800 34,000 12,800 0 $62,720 $1,280 U $64,000 $4,000 27,520 640 $35,200 $1,920 34,100 100 U $37,120 $2,320 U 34,000 0 $1,100 $2,020 U $3,120 $2,320 F $800

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 B Expected results in the flexible budget for the ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started