Question

On January 1, 2014, Norton Corporation acquired a 15% interest in Liddy Corporation for $120,000 when Liddy's stockholder's equity consisted of $600,000 capital stock and

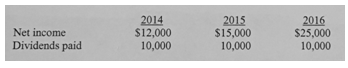

On January 1, 2014, Norton Corporation acquired a 15% interest in Liddy Corporation for $120,000 when Liddy's stockholder's equity consisted of $600,000 capital stock and $200,000 retained earnings. Book values of Liddy's net assets equaled their fair values on this date. Liddy's net income and dividends for 2014 through 2016 are as follows:

1. Assume that Norton uses the cost method of accounting for its investment in Liddy. The balance in the Investment in Liddy account at December 31, 2016 will be:

2. Assume that Norton has significant influence and uses the equity method of accounting for its investment in Liddy. The balance in the Investment in Liddy account at December 31, 2016 will be:

3. Pacana Corporation paid 5200,000 for a 25% interest in Sillypad Corporation's common stock on January I, 2014. but was not able to exercise significant influence over Sillypad. During 2016 Pacana reported income of 5120,000, excluding its income from Silypad, and paid dividends of 550.000. Sillypad reported net income of 540,000 during 2016 and paid dividends of 520.000. Pacana should report net income for 2016 in the amount of?

Net income. Dividends paid 2014 $12,000 10,000 2015 $15,000 10,000 2016 $25,000 10,000

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 With the cost method the balance if investment in liddys accounts is 120000purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started