Question

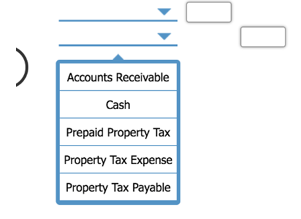

On January 1, the Newman Company estimated its property tax to be $3,360 for the year,. (a) How much should the company accrue each month

On January 1, the Newman Company estimated its property tax to be $3,360 for the year,.

(a) How much should the company accrue each month for property taxes?

(b) Calculate the balance in Property Tax Payable as of August 31.

(c) Prepare the adjusting journal entry for the month of September.

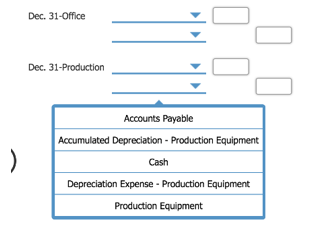

DogMart Company records depreciation for equipment. Depreciation for the period ending December 31 is $3,280 for office equipment and $8,000 for production equipment. Prepare two entries to record the deprecation.

) Accounts Receivable Cash Prepaid Property Tax Property Tax Expense Property Tax Payable 0 ) Dec. 31-Office Dec. 31-Production Accounts Payable Accumulated Depreciation - Production Equipment Cash Depreciation Expense - Production Equipment Production Equipment

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Amount accrued by the company each month for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60951467c344b_25524.pdf

180 KBs PDF File

60951467c344b_25524.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started