Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 resulting in a 4% discount.

On January 1, Year 1 Residence Company issued bonds with a $50,000 face value. The bonds were issued at 96 resulting in a 4% discount. They had a 20 year term and a stated rate of interest of 7%. The company amortizes the discount on a straight-line basis. Which of the following shows how the recognition of interest expense will affect Residence?s financial statements on December 31, Year 1?

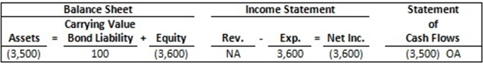

(a)

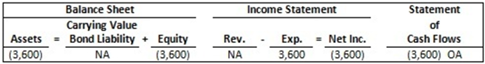

(b)

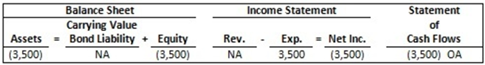

(c)

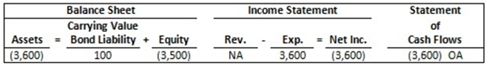

(d)

Balance Sheet Carrying Value Assets = Bond Liability + Equity (3,500) 100 (3,600) Income Statement Rev. Exp. = Net Inc. 3,600 (3,600) Statement of Cash Flows (3,500) OA Balance Sheet Carrying Value Assets = Bond Liability + Equity (3,600) (3,600) Rev. Income Statement Exp. = Net Inc. 3,600 (3,600) Statement of Cash Flows (3,600) OA Balance Sheet Carrying Value Assets = Bond Liability + Equity (3,500) (3,500) Income Statement Rev. Exp. - Net Inc. 3,500 (3,500) Statement of Cash Flows (3,500) OA Balance Sheet Carrying Value Assets = Bond Liability + Equity (3,600) 100 (3,500) Rev. Income Statement Exp. = Net Inc. 3,600 (3,600) Statement of Cash Flows (3,600) OA

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Option a Here the Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started