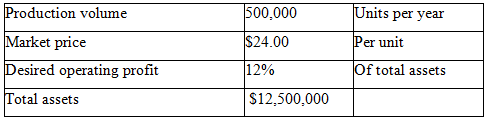

Origami Company is a price-taker and uses target pricing. Please refer to the following information: How much is the target full cost in total for

Origami Company is a price-taker and uses target pricing. Please refer to the following information:

How much is the target full cost in total for the year?

A) $1,440,000

B) $10,500,000

C) $12,000,000

D) $1,500,000

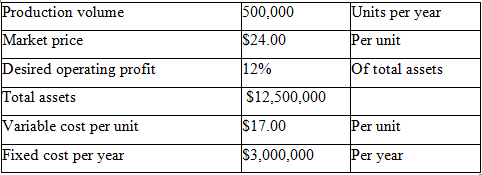

Origami Company is a price-taker and uses target pricing. Please refer to the following information:

With the current cost structure, Origami cannot achieve its profit goals. It will have to reduce either the fixed costs or the variable costs. Assuming that fixed costs CANNOT be reduced, how much will the target variable costs per year be?

A) $7,500,000

B) $12,500,000

C) $2,500,000

D) $8,000,000

Origami Company is a price-taker and uses target pricing. Please refer to the following information:

With the current cost structure, Origami cannot achieve its profit goals. It will have to reduce either the fixed costs or the variable costs. Assuming that fixed costs CANNOT be reduced, how much will the target variable costs per unit be? (Please round to nearest cent.)

A) $14.67

B) $16.25

C) $15.00

D) $17.50

Dylan Company is considering an investment in new equipment costing $720,000. The equipment will be depreciated on a straight-line basis over a five-year life and is expected to have a salvage value of $45,000. The equipment is expected to generate net cash flows totaling $970,000 during the five years. What is the rate of return associated with the equipment investment?

A) 15.4%

B) 16.4%

C) 30.4%

D) 13.9%

Clapton Corporation is considering an investment in new equipment costing $900,000. The equipment will be depreciated on a straight-line basis over a ten-year life and is expected to have a salvage value of $90,000. The equipment is expected to generate net cash flows of $140,000 for each of the first five years and $100,000 for each of the last five years. What is the accounting rate of return associated with the equipment investment?

A) 12.1%

B) 7.9%

C) 17.3%

D) 9.7%

Wasson Corporation is considering an investment project costing $520,000. The project is estimated to have an eight-year life, generate annual cash flows of $120,000, and have a salvage value of $40,000 after eight years. What is the project's payback period?

A) 2.8 years

B) 4.3 years

C) 4 years

D) 6.5 years

Origami Company is a price-taker and uses target pricing. Please refer to the following information:

With the current cost structure, Origami cannot achieve its profit goals. It will have to reduce either the fixed costs or the variable costs. Assuming that fixed costs CANNOT be reduced, how much will the target variable costs per unit be? (Please round to nearest cent.)

A) $14.67

B) $16.25

C) $15.00

D) $17.50

Dylan Company is considering an investment in new equipment costing $720,000. The equipment will be depreciated on a straight-line basis over a five-year life and is expected to have a salvage value of $45,000. The equipment is expected to generate net cash flows totaling $970,000 during the five years. What is the rate of return associated with the equipment investment?

A) 15.4%

B) 16.4%

C) 30.4%

D) 13.9%

Clapton Corporation is considering an investment in new equipment costing $900,000. The equipment will be depreciated on a straight-line basis over a ten-year life and is expected to have a salvage value of $90,000. The equipment is expected to generate net cash flows of $140,000 for each of the first five years and $100,000 for each of the last five years. What is the accounting rate of return associated with the equipment investment?

A) 12.1%

B) 7.9%

C) 17.3%

D) 9.7%

Wasson Corporation is considering an investment project costing $520,000. The project is estimated to have an eight-year life, generate annual cash flows of $120,000, and have a salvage value of $40,000 after eight years. What is the project's payback period?

A) 2.8 years

B) 4.3 years

C) 4 years

D) 6.5 years

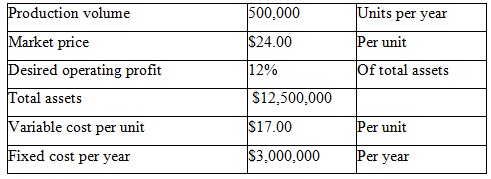

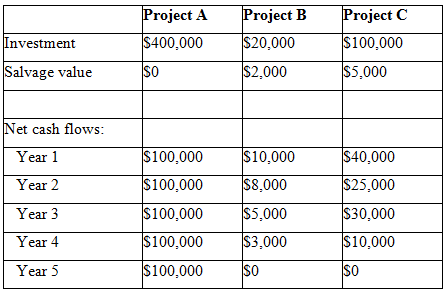

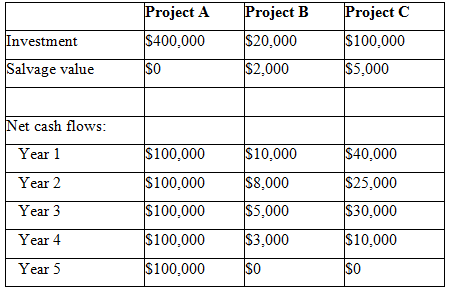

A company is evaluating 3 possible investments. Each uses straight-line depreciation. See data below:

What is the payback period for Project A?

A) 3.5 years

B) 4.5 years

C) 4.0 years

D) 5.0 years

A company is evaluating 3 possible investments. Each uses straight-line depreciation. See data below:

What is the rate of return for Project A?

A) 50%

B) 4%

C) 16%

D) 10%

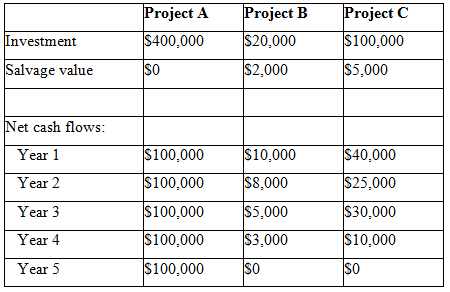

Sun Company is considering purchasing new equipment costing $350,000. Sun's management has estimated that the equipment will generate cash inflows as follows:

Year 1??????..$100,000

Year 2??????..$100,000

Year 3??????..$125,000

Year 4??????..$125,000

Year 5??????..$75,000

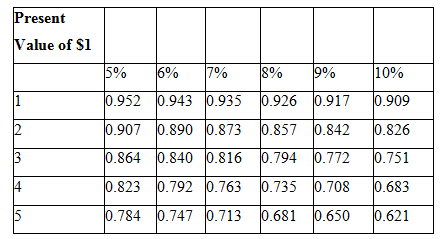

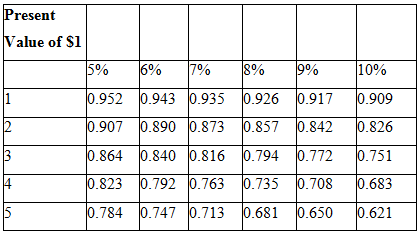

Using the factors in the table below, please calculate the net present value of the net cash inflows above, using a discount rate of 10%. Please round all calculations to the nearest whole dollar.

A) $399,325

B) $342,800

C) $401,667

D) $399,761

Sun Company is considering purchasing new equipment costing $350,000. Sun's management has estimated that the equipment will generate cash inflows as follows:

Year 1???????????$100,000

Year 2???????????$100,000

Year 3???????????$125,000

Year 4???????????$125,000

Year 5???????????..$75,000

Using the table below, please calculate the profitability index of the project using a discount rate of 10%. Please round all calculations to the nearest whole dollar.

A) 1.67

B) 2.07

C) 1.20

D) 1.14

Which of the following describes the term time value of money ?

A) Money can only be used at certain times and for certain purposes.

B) Money loses its purchasing power over time through inflation.

C) Wasted time can result in wasted money.

D) When money is invested over time, it earns income and grows.

Which of the following MOST accurately describes the term annuity ?

A) An investment which grows in value over time

B) An installment loan with amortizing principal payments

C) A stream of equal installments of cash payments

D) A term life insurance policy

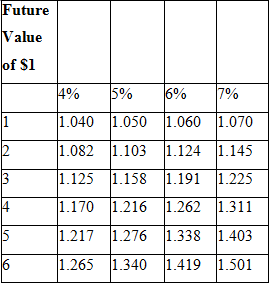

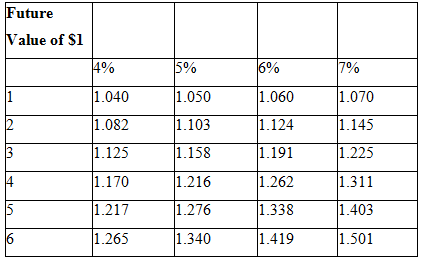

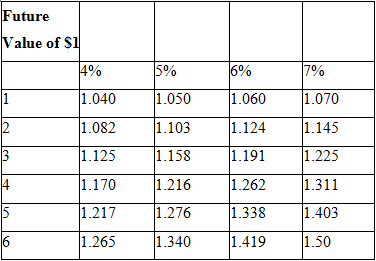

If $1,000 is invested in an account with 4% interest compounding yearly, what will the balance of the account be after 4 years? (You may ignore small differences that result from rounding.)

A) $1,218

B) $1,170

C) $1,040

D) $1,240

If $1,000 is invested in an account with 4% interest compounding yearly, what will the balance of the account be after 4 years? Please refer to the following Future Value table:

A) $1,218

B) $1,170

C) $1,040

D) $1,240

If $2,000 is invested in an account with 5% interest compounding yearly, what will the balance of the account be after 6 years? Please refer to the following Future Value table:

A) $1,340

B) $2,680

C) $2,676

D) $2,432

If $5,000 is invested in an account with 7% interest compounding yearly, what will the balance of the account be after 3 years? Please refer to the following Future Value table:

A) $6,180

B) $6,211

C) $5,867

D) $6,125

Which of the following is NOT a characteristic of the budgeting process?

A) The budget process aids in performance evaluation.

B) The budget process helps coordinate the activities of the organization.

C) The budget process forces management to plan ahead.

D) The budget process ensures that the business will make a profit.

Which of the following statements about budgeting is INCORRECT?

A) Budgeting is an accounting function and does not need involvement of operations personnel.

B) Budgeting is an aid to planning and control.

C) Budgets help to coordinate the activities of the entire organization.

D) Budgets promote communication and coordination between departments.Which of the following is an example of the planning function of a budget?

A) A budget demands integrated input from different business units and functions.

B) Employees are motivated to achieve the goals set by the budget.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

) Which of the following is an example of the coordination and communication function of a budget?

A) A budget demands integrated input from different business units and functions.

B) Employees are motivated to achieve the goals set by the budget.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

Which of the following is an example of the benchmarking function of a budget?

A) A budget demands integrated input from different business units and functions.

B) Budgeting requires close cooperation between accountants and operational personnel.

C) Budget figures are used to evaluate the performance of managers.

D) The budget outlines a specific course of action for the coming period.

Argyle Company is preparing the operating budget for the first quarter of 2012. They forecast sales of $50,000 in January, $60,000 in February, and $70,000 in March. Variable and fixed expenses are as follows:

Variable: Power cost (40% of Sales)

Miscellaneous expenses (5% of Sales)

Fixed: Salary expense: $8,000 per month

Rent expense: $5,000 per month

Depreciation expense: $1,200 per month

Power cost/fixed portion: $800 per month

Miscellaneous expenses/fixed portion: $1,000 per month

How much is the total operating expense for January?

A) $38,500

B) $47,500

C) $41,700

D) $43,000

Production volume Market price Desired operating profit Total assets 500,000 $24.00 12% $12,500,000 Units per year Per unit Of total assets Production volume Market price Desired operating profit Total assets Variable cost per unit Fixed cost per year 500,000 $24.00 12% $12,500,000 $17.00 $3,000,000 Units per year Per unit Of total assets Per unit Per year Production volume Market price Desired operating profit Total assets Variable cost per unit Fixed cost per year 500,000 $24.00 12% $12,500,000 $17.00 $3,000,000 Units per year Per unit Of total assets Per unit Per year Investment Salvage value Net cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Project A $400,000 SO $100,000 $100,000 $100,000 $100,000 $100,000 Project B $20,000 $2,000 $10,000 $8,000 $5,000 $3,000 SO Project C $100,000 $5,000 $40,000 $25,000 $30,000 $10,000 SO Investment Salvage value Net cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Project A $400,000 SO $100,000 $100,000 $100,000 $100,000 $100,000 Project B $20,000 $2,000 $10,000 $8,000 $5,000 $3,000 SO Project C $100,000 $5,000 $40,000 $25,000 $30,000 $10,000 SO Investment Salvage value Net cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Project A $400,000 SO $100,000 $100,000 $100,000 $100,000 $100,000 Project B $20,000 $2,000 $10,000 $8,000 $5,000 $3,000 SO Project C $100,000 $5,000 $40,000 $25,000 $30,000 $10,000 SO Present Value of $1 1 2 3 14 5 5% 6% 7% 8% 9% 0.952 0.943 0.935 0.926 0.917 0.907 0.890 0.873 0.857 0.842 0.864 0.840 0.816 0.823 0.792 0.763 0.735 0.708 0.784 0.747 0.713 0.681 0.650 10% 0.909 0.826 0.794 0.772 0.751 0.683 0.621 Present Value of $1 1 12 3 14 5 5% 6% 7% 8% 9% 0.952 0.943 0.935 0.926 0.917 0.907 0.890 0.873 0.857 0.842 0.864 0.840 0.816 0.794 0.772 0.823 0.792 0.763 0.735 0.708 0.784 0.747 0.713 0.681 0.650 10% 0.909 0.826 0.751 0.683 0.621 Future Value of $1 1 12 3 4 5 6 4% 1.040 1.050 1.082 1.103 1.125 1.158 1.170 1.216 1.217 1.276 1.265 1.340 1.340 5% 6% 7% 1.060 1.060 1.070 1.124 1.145 1.191 1.225 1.262 1.311 1.338 1.403 1.419 1.419 1.501 Future Value of $1 1 12 3 4 5 16 4% 1.040 1.082 1.125 1.170 1.217 1.265 5% 1.050 1.103 1.158 1.216 1.276 1.340 6% 1.060 1.124 1.191 1.262 1.338 1.419 7% 1.070 1.145 1.225 1.311 1.403 1.501 Future Value of $1 1 2 3 15 6 4% 1.040 1.082 1.125 1.170 1.217 1.265 5% 1.050 1.103 1.158 1.216 1.276 1.340 6% 1.060 1.124 1.191 1.262 1.338 1.419 7% 1.070 1.145 1.225 1.311 1.403 1.50

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

B D D A Calculations Depreciation 720000 450005 135000 ARR 9700005 720000450005 720000 450002 590003...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started