Question

Part A: Luxury Living Concepts Corp. (LLC) is a publicly accountable enterprise that builds large complexes, including schools, office towers, apartment buildings and shopping centres,

Part A:

Luxury Living Concepts Corp. (LLC) is a publicly accountable enterprise that builds large complexes, including schools, office towers, apartment buildings and shopping centres, on a contract basis. Additional information with respect to the company is as follows:

LLC's year end is December 31.

The company uses the cost-to-cost approach to determine the stage of completion of its construction projects.

The enterprise rounds the percentage of completion to two decimal places (for example. 13.54%).

A discount rate of 4% adequately reflects the underlying credit risk of LLC's customer for this transaction.

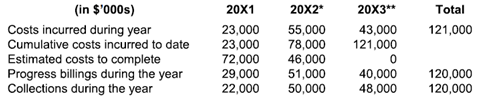

In 20X1, LLC entered into a $120 million contract to construct a shopping mall over a three-year period. Construction of the project was completed in late 20X3. Total costs were originally estimated to be $98 million. LLC's progress on the contract and other pertinent information is detailed below:

*The revised cost data was not known in 20X1.

**The revised cost data was not known in 20X2.

Required:

(a) Prepare the required journal entries to record transactions relating to the contracts for the 20X1, 20X2 and 20X3 fiscal periods. Show all supporting calculations for each journal entry. The calculations are to be referenced or included in the description of the journal entry.

(b) Prepare the excerpts of LLC's statements of financial position as at December 31, 20X1 and December 31, 20X2 (exclude the impact on cash and retained earnings).

Part B:

Refer to the facts in Part A. Independent of the requirements in Part A, assume that the additional cost in 20X2 resulted from changes to the project requested by the customer in 20X2 and that the customer agreed to increase the contract price to $140 million. The additional $20 million was added by LLC to its final progress billing in 20X3 and was paid by the customer during that year.

Required:

(a) Determine the revenue to be recognized by LLC in each of 20X1, 20X2 and 20X3.

(b) Determine the expense to be recognized by LLC in each of 20X1, 20X2 and 20X3.

Show all supporting calculations for requirements (a) and (b) to be eligible to receive partial marks.

(in $'000s) Costs incurred during year Cumulative costs incurred to date Estimated costs to complete Progress billings during the year Collections during the year 20X1 20X2* 23,000 55,000 23,000 78,000 72,000 46,000 29,000 51,000 22,000 50,000 20X3** 43,000 121,000 0 40,000 48,000 Total 121,000 120,000 120,000

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Part A a Revenue ac DR 000 CR 000 revenue from contract 120000 progress ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started