Question: Using the following Information, Answer the multiple Questions Use the following information to answer questions 1 and 2. Awesome Inc. Statement of financial position As

Using the following Information, Answer the multiple Questions

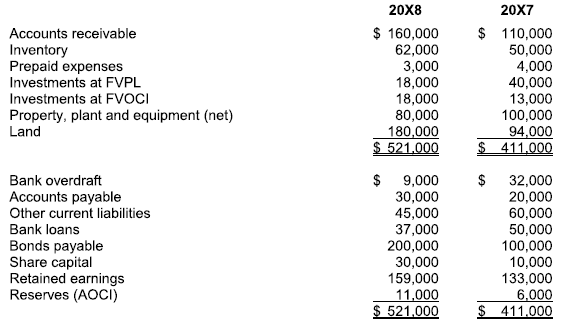

Use the following information to answer questions 1 and 2.

Awesome Inc.

Statement of financial position

As at December 31

Awesome Inc.

Statement of comprehensive income

Year ended December 31

Additional information:

- In 20X8. Awesome issued $100,000 in bonds to acquire land with a fair value of $100,000.

1. What is the amount of net cash provided by (used in) investing activities that Awesome will report on its statement of cash flows for its year ended December 31, 20X8?

(a) $14,000 cash inflow

(b) $19,000 cash inflow

(c) $39,000 cash inflow

(d) $86,000 cash outflow 2. What is the amount of net cash provided by (used in) financing activities that Awesome will report on its statement of cash flows for its year ended December 31, 20X8?

(a) $3,000 cash inflow

(b) $7,000 cash inflow

(c) $97,000 cash outflow

(d) $117,000 cash outflow

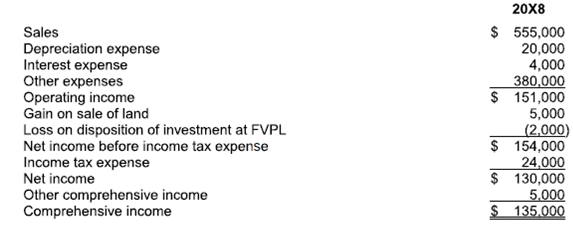

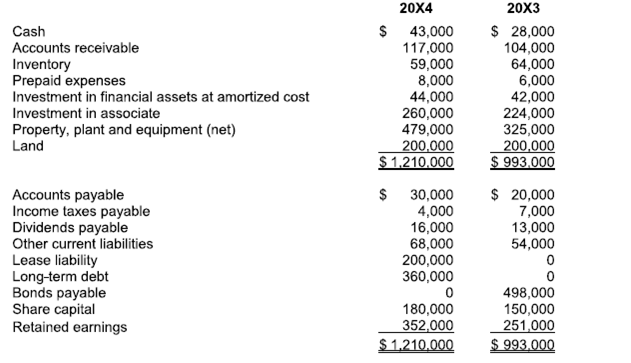

Use the following information to answer questions 3 and 4.

Fantasy Corp.

Statement of financial position

As at December 31

Fantasy Corp.

Statement of comprehensive income

Year ended December 31

Additional information:

- A $30,000 stock dividend was declared and distributed during 20X4.

- $200,000 of right-of-use equipment was acquired under a lease at the end of 20X4.

- Equipment with a net book value of S70,000 was disposed of during 20X4.

- The change in value of the investment in financial assets at amortized cost was due to amortization of the discount.

- Fantasy shareholdings in its associate did not change during the year.

3. What is the amount of net cash provided by (used in) investing activities that Fantasy will report on its statement of cash flows for its year ended December 31, 20X4?

(a) $46,000 cash inflow

(b) $14,000 cash outflow

(c) $24,000 cash outflow

(d) $154,000 cash outflow

4. What is the amount of net cash used in financing activities that Fantasy will report on its statement of cash flows for its year ended December 31, 20X4?

(a) $195,000 cash outflow

(b) $198,000 cash outflow

(c) $201,000 cash outflow

(d) $225,000 cash outflow

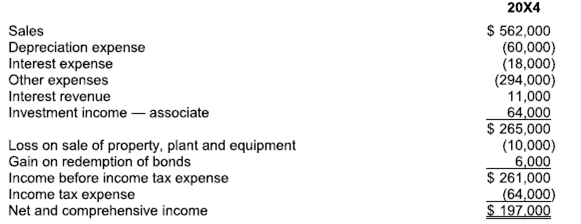

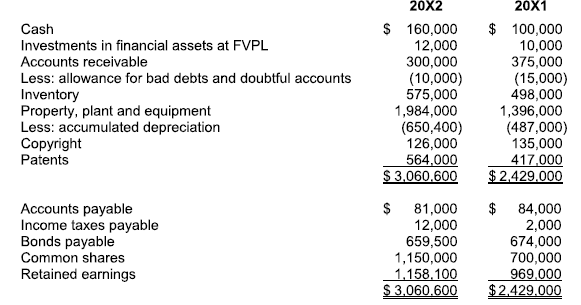

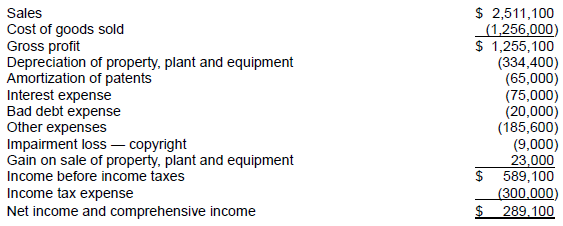

5. The following information has been extracted from Direct to You Copr's (DYC) financial records for its year ended December 31, 20X2:

Direct to You Corp.

Statement of financial position

As at December 31

Direct to You Corp.

Statement of financial position

As at December 31

Additional information:

- DYC prepares the cash from operating activities section of its statement of cash flows using the direct method.

- DYC elects to classify cash inflows from interest and dividends as operating activities, and the payment of interest and dividends as financing activities.

- Property, plant and equipment that originally cost $570,000 was sold during the year.

- 100,000 common shares were issued in 20X2 to acquire $450,000 of property, plant and equipment.

- The decrease in the bonds payable account was due to the amortization of the premium.

What is the amount of net cash used in investing activities that DYC will report on its statement of cash flows for its year ended December 31, 20X2?

(a) $433,000 cash outflow

(b) $498,000 cash outflow

(c) $521,000 cash outflow

(d) $948,000 cash outflow

Accounts receivable Inventory Prepaid expenses Investments at FVPL Investments at FVOCI Property, plant and equipment (net) Land Bank overdraft Accounts payable Other current liabilities Bank loans Bonds payable Share capital Retained earnings Reserves (AOCI) 20X8 $ 160,000 62,000 3,000 18,000 18,000 80,000 180,000 $ 521.000 $ 9,000 30,000 45,000 37,000 200,000 30,000 159,000 11,000 $ 521,000 20X7 $ 110,000 50,000 4,000 $ $ 40,000 13,000 100,000 94,000 411.000 32,000 20,000 60,000 50,000 100,000 10,000 133,000 6,000 $ 411,000 Sales Depreciation expense Interest expense Other expenses Operating income Gain on sale of land Loss on disposition of investment at FVPL Net income before income tax expense Income tax expense Net income Other comprehensive income Comprehensive income 20X8 $ 555,000 20,000 4,000 380,000 $ 151,000 5,000 (2,000) $ $ 130,000 5.000 $ 135.000 154,000 24,000 Cash Accounts receivable Inventory Prepaid expenses Investment in financial assets at amortized cost Investment in associate Property, plant and equipment (net) Land Accounts payable Income taxes payable Dividends payable Other current liabilities Lease liability Long-term debt Bonds payable Share capital Retained earnings $ 20X4 43,000 117,000 59,000 8,000 44,000 260,000 479,000 200,000 $ 1,210,000 $ 30,000 4,000 16,000 68,000 200,000 360,000 0 180,000 352,000 $1,210,000 20X3 $ 28,000 104,000 64,000 6,000 42,000 224,000 325,000 200,000 $ 993,000 $ 20,000 7,000 13,000 54,000 0 0 498,000 150,000 251,000 $ 993.000 Sales Depreciation expense Interest expense Other expenses Interest revenue Investment income-associate Loss on sale of property, plant and equipment Gain on redemption of bonds Income before income tax expense Income tax expense Net and comprehensive income 20X4 $ 562,000 (60,000) (18,000) (294,000) 11,000 64,000 $ 265,000 (10,000) 6,000 $ 261,000 (64,000) $ 197,000 Cash Investments in financial assets at FVPL Accounts receivable Less: allowance for bad debts and doubtful accounts Inventory Property, plant and equipment Less: accumulated depreciation Copyright Patents Accounts payable Income taxes payable Bonds payable Common shares Retained earnings 20X2 $ 160,000 12,000 300,000 (10,000) 575,000 1,984,000 (650,400) 126,000 564,000 $ 3,060,600 $ 81,000 12,000 659,500 1,150,000 1,158,100 $ 3,060,600 20X1 $ 100,000 10,000 375,000 (15,000) 498,000 1,396,000 (487,000) 135,000 417,000 $ 2,429,000 $ 84,000 2,000 674,000 700,000 969,000 $2,429.000 Sales Cost of goods sold Gross profit Depreciation Amortization of patents of property, plant and equipment Interest expense Bad debt expense Other expenses Impairment loss - copyright Gain on sale of property, plant and equipment Income before income taxes Income tax expense Net income and comprehensive income $ 2,511,100 (1,256,000) $ 1,255,100 $ $ (334,400) (65,000) (75,000) (20,000) (185,600) (9,000) 23,000 589,100 (300,000) 289.100

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

To solve these problems we must calculate the net cash flows from investing and financing activities for each company based on the provided informatio... View full answer

Get step-by-step solutions from verified subject matter experts