Question

Pryor Company's net incomes for the past three years are presented below: After the 2013 reported year-end, the following items come to your attention: Pryor

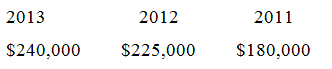

Pryor Company's net incomes for the past three years are presented below:

After the 2013 reported year-end, the following items come to your attention:

Pryor bought a truck January 1, 2010 for $98,000 with an $8,000 estimated salvage value and a six-year life. The company debited an expense account and credited cash on the purchase date for the entire cost of the asset. (Straight-line depreciation should have been used.)

Pryor purchased a cement plant on January 1, 2011 for $180,000?estimated useful life, 10 years, no salvage value and straight-line depreciation was used. At the beginning of 2013, Pryor changed from straight-line to the double-declining balance depreciation method. Original useful live and salvage estimates remain unchanged.

The net income for 2013 was computed on the double-declining balance method for the cement plant and did not reflect any depreciation related to the truck expensed in 2010.

Prepare the entries necessary to correct the books for the truck transaction assuming straight-line depreciation should be used and the books have been closed for 2013.

Calculate the DDB depreciation recorded in 2013 for the cement plant.

Present revised income statement data for the years 2011 to 2013 in accordance with generally accepted accounting principles starting with income amounts reported above. Ignore all income tax effects and earnings per share amounts.

Assume that the beginning retained earnings balances (unadjusted) for 2011 was $630,000, for 2012 was $810,000 and for 2013 was $1,035,000 and no dividends were paid during those periods, prepare the revised retained earnings statements for the 3 years.

2013 $240,000 2012 $225,000 2011 $180,000

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

particulars Debit Credit Cash TO expenses account 9800...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started