Question

Read Case Study: American Investment Management Services: *Including trades for which AIMS charged an average of $30. (through a broker) or $16. (on-line). It should

Read Case Study: American Investment Management Services:

*Including trades for which AIMS charged an average of $30. (through a broker) or $16. (on-line). It should be clear that many transactions are not trades and thus are not revenue producing (name changes, address changes, dividend payments, or stock splits, for example).

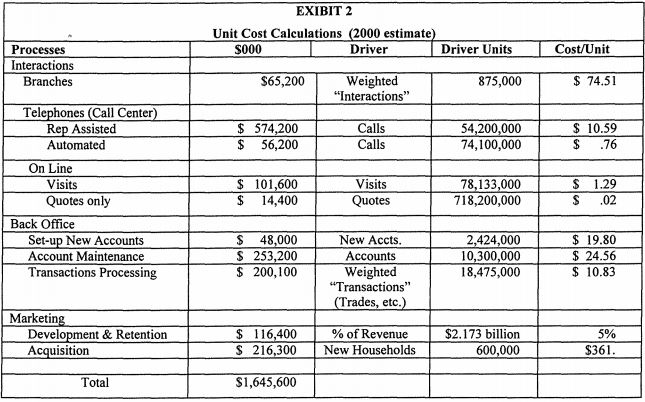

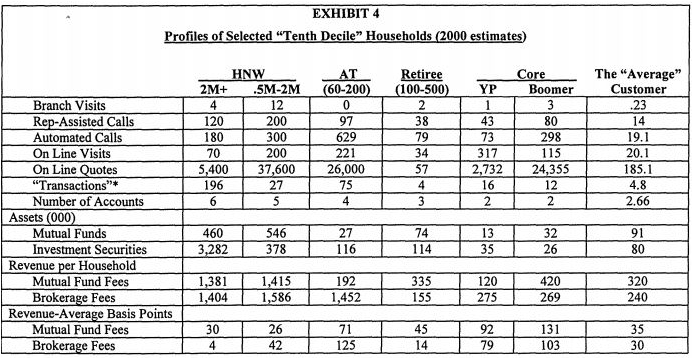

a) Using ABC analysis, and the information in Exhibits 2 and 4, calculate the loss per household for the six customer profiles per Exhibit 4. Round your calculations to the nearest dollar.

b) What are two specific management actions for each of the six customer profiles that would substantially improve the profitability? Calculate the impact of these actions to the nearest dollar.

Processes Interactions Branches Telephones (Call Center) Rep Assisted Automated On Line Visits Quotes only Back Office Set-up New Accounts Account Maintenance Transactions Processing Marketing Development & Retention Acquisition Total EXIBIT 2 Unit Cost Calculations (2000 estimate) $000 Driver $65,200 $ 574,200 $ 56,200 $ 101,600 $ 14,400 $ 48,000 $ 253,200 $ 200,100 $116,400 $ 216,300 $1,645,600 Weighted "Interactions" Calls Calls Visits Quotes New Accts. Accounts Weighted "Transactions" (Trades, etc.) % of Revenue New Households Driver Units 875,000 54,200,000 74,100,000 78,133,000 718,200,000 2,424,000 10,300,000 18,475,000 $2.173 billion 600,000 Cost/Unit $74.51 $10.59 $ .76 $ 1.29 .02 $19.80 $24.56 $10.83 5% $361. Branch Visits Rep-Assisted Calls Automated Calls On Line Visits On Line Quotes "Transactions"* Number of Accounts Assets (000) EXHIBIT 4 Profiles of Selected "Tenth Decile" Households (2000 estimates) Mutual Funds Investment Securities Revenue per Household Mutual Fund Fees Brokerage Fees Revenue-Average Basis Points Mutual Fund Fees Brokerage Fees 2M+ 4 120 180 70 5,400 196 6 460 3,282 1,381 1,404 30 4 HNW .5M-2M 12 200 300 200 37,600 27 5 546 378 1,415 1,586 26 42 AT (60-200) 0 97 629 221 26,000 75 4 27 116 192 1,452 71 125 Retiree (100-500) 2 38 79 34 57 4 3 74 114 335 155 45 14 YP 1 43 73 317 2,732 16 2 13. 35 120 275 92 79 Core Boomer 3 80 298 115 24,355 12 2 32 26 420 269 131 103 The "Average" Customer .23 14 19.1 20.1 185.1 4.8 2.66 91 80 320 240 35 30

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Loss per household is 5 b Detailed information of the ideal custome...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started