Question

Read the overview below and complete the activities that follow. Auditors must gather a combination of many types of audit evidence to best reduce their

Read the overview below and complete the activities that follow.

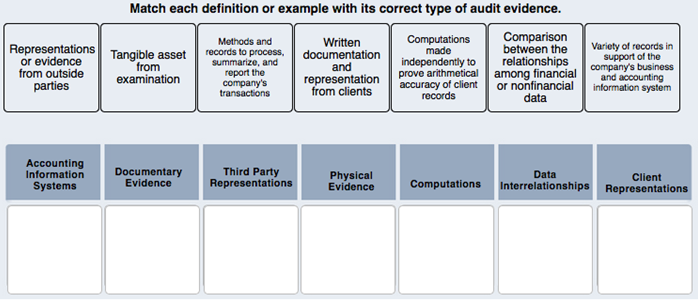

Auditors must gather a combination of many types of audit evidence to best reduce their audit risk. There are seven major types of audit evidence: 1) accounting information system, 2) documentary evidence, 3) third-party representation, 4) physical evidence, 5) computations, 6) data interrelationships, and 7) client representations.

Concept Review:

Audit evidence is any information that corroborates or refutes the auditors' premise that the financial statements present fairly the client's financial position and operating results.

Representations or evidence from outside parties Accounting Information Systems Match each definition or example with its correct type of audit evidence. Comparison between the relationships Tangible asset from examination Documentary Evidence Methods and records to process, summarize, and report the company's transactions Third Party Representations Written documentation and representation from clients Physical Evidence Computations made independently to prove arithmetical accuracy of client records Computations among financial or nonfinancial data Variety of records in support of the company's business and accounting information system Data Client Interrelationships Representations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Accounting information system Methods and records to process ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started