Question

Refer to the S&P data. Using S& P as your independent variable select two companies Apple (APPL) and Amazon (AMZN) and run a regression for

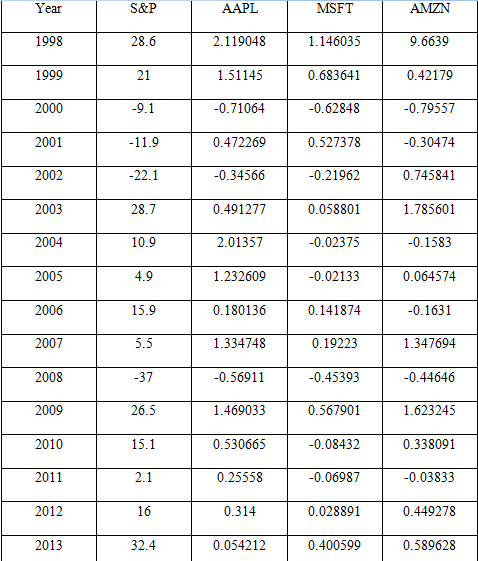

Refer to the S&P data. Using S& P as your independent variable select two companies Apple (APPL) and Amazon (AMZN) and run a regression for the two companies while suppressing the intercept term.

(b) Interpret the results of your coefficients.

(c) Suppose you have been entrusted with the responsibility to manage a large amount of money, what managerial decision will you make in terms of investing the money in either of the companies? Why?

Where S& P is for stock market return, AMZN is for returns on Amazon stock, AAPL is for returns on Apple stock, and MSFT is for returns on Microsoft stock

Year 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 S&P 28.6 21 -9.1 -11.9 -22.1 28.7 10.9 4.9 15.9 5.5 -37 26.5 15.1 2.1 16 32.4 AAPL 2.119048 1.51145 -0.71064 0.472269 -0.34566 0.491277 2.01357 1.232609 0.180136 1.334748 -0.56911 1.469033 0.530665 0.25558 0.314 0.054212 MSFT 1.146035 0.683641 -0.62848 0.527378 -0.21962 0.058801 -0.02375 -0.02133 0.141874 0.19223 -0.45393 0.567901 -0.08432 -0.06987 0.028891 0.400599 AMZN 9.6639 0.42179 -0.79557 -0.30474 0.745841 1.785601 -0.1583 0.064574 -0.1631 1.347694 -0.44646 1.623245 0.338091 -0.03833 0.449278 0.589628

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Lets redraw the table for AAPL stock assigningxandyvariables Year SP x AAPL y x x y y bar x x y y ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started