Question

Sanchez Metal Products Company had the following balances, among others, at the end of December 2001: Cash, 8300000; Equipment, 5400.000; Accumulated Depreciation, 5100000. Total revenues

Sanchez Metal Products Company had the following balances, among others, at the end of December 2001: Cash, 8300000; Equipment, 5400.000; Accumulated Depreciation, 5100000. Total revenues (all in cash) were $900, 000. All operating expenses except depreciation were for cash and totaled $600.000. Straight-line depreciation expense was $61000. Depreciation expense would have been $110,000 it Sanchez had used accelerated depreciation.

1. Assume zero Income taxes. Flit In the first two columns of blanks In the accompanying table. Show the amounts in thousands.

2. Fill In the last two columns of blanks in the table above. Assume an income tax rate of 40%. Assume also that Sanchez uses the same depreciation method for reporting to shareholders and to Income tax authorities.

3. Compare your answers to requirements 1 and 2. Does depreciation provide cash? Explain as precisely as possible.

4. Refer to requirement 2. Assume that Sanchez had used straight-line depreciation for reporting to shareholders and to income tax authorities indicate the change (Increase or decrease and amount) in the following balances if Sanchez had used accelerated depreciation foe shareholder and tax reporting instead of straight-line: Cash, Accumulated Depreciation, Pretax Income, Income Tax Expense, and Retained Earnings.

5. Refer to requirement 1 where there are zero taxes. Suppose depreciation was doubled under both straight-line and accelerated methods. How would this affect cash? Be specific

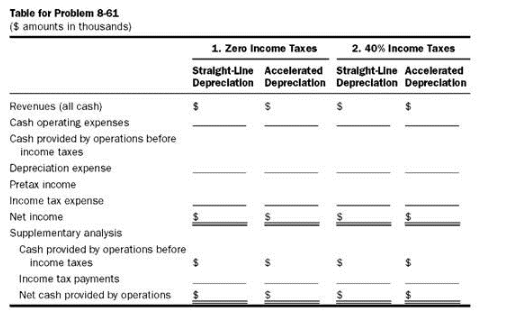

Table for Problem 8-61 ($ amounts in thousands) Revenues (all cash) Cash operating expenses Cash provided by operations before income taxes Depreciation expense Pretax income Income tax expense Net income Supplementary analysis Cash provided by operations before income taxes 1. Zero Income Taxes 2. 40% Income Taxes Straight-Line Accelerated Straight-Line Accelerated Depreciation Depreciation Depreciation Depreciation Income tax payments Net cash provided by operations $ $

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 We need to fill cut first two columns of the table assuming no income taxes We can calculate the cash provided by operations before income taxes by subtracting the cash operating expenses or 600000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60936cab50d42_23797.pdf

180 KBs PDF File

60936cab50d42_23797.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started