Shoehorn Company sells two types of shoes - budget shoes and premium shoes. Though only recently introducing premium shoes, the company is astounded by the

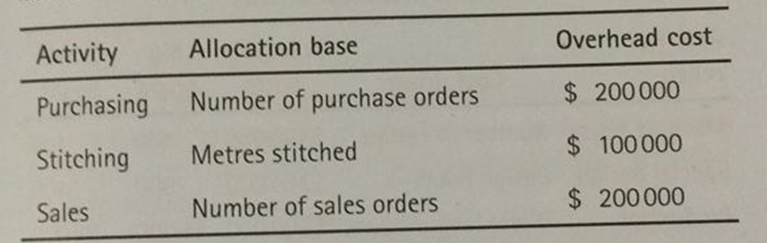

Shoehorn Company sells two types of shoes - budget shoes and premium shoes. Though only recently introducing premium shoes, the company is astounded by the profit margin on that product. On the other hand, the returns on the budget shoes have declined since premium shoes started being made and sold. The expected production and sales are 1,000 premium shoes and 20,000 budget shoes. Company management is concerned at the traditional overhead cost allocation system being used to cost overhead into the shoes and accumulated the following data from last year in order to conduct an activity based costing overhead allocation:

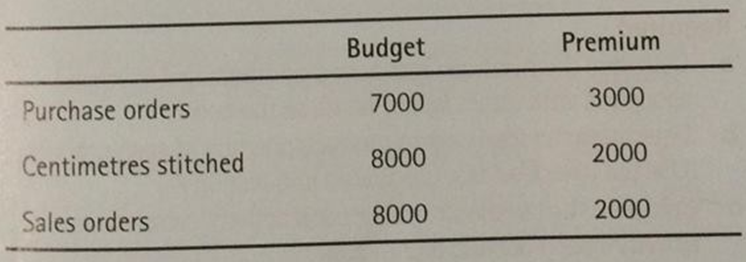

The numbers of activities for budget shoes and premium shoes are as follows:

Required:

a. Calculate the overhead rates for the following activities: purchasing, stitching and sales orders. b. Calculate the dollar amount of overhead that should be assigned to a budget shoe and a premium shoe, under the ABC system.

Activity Purchasing Stitching Sales Allocation base Number of purchase orders Metres stitched Number of sales orders Overhead cost $ 200 000 $ 100000 $ 200000 Purchase orders Centimetres stitched Sales orders Budget 7000 8000 8000 Premium 3000 2000 2000

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Overhead Rate for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609576c678191_25893.pdf

180 KBs PDF File

609576c678191_25893.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started