Answered step by step

Verified Expert Solution

Question

1 Approved Answer

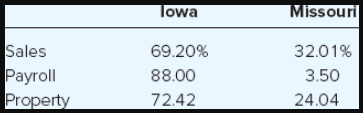

Susie?s Sweet Shop has the attached sales, payroll, and property factors: What are Susie?s Sweet Shop?s Iowa and Missouri apportionment factors under each of the

Susie?s Sweet Shop has the attached sales, payroll, and property factors: What are Susie?s Sweet Shop?s Iowa and Missouri apportionment factors under each of the following alternative scenarios? Iowa and Missouri both use a three-factor apportionment formula. Iowa and Missouri both use a four-factor apportionment formula that double-weights sales. Iowa uses a three-factor formula and Missouri uses a single-factor apportionment formula (based solely on sales).

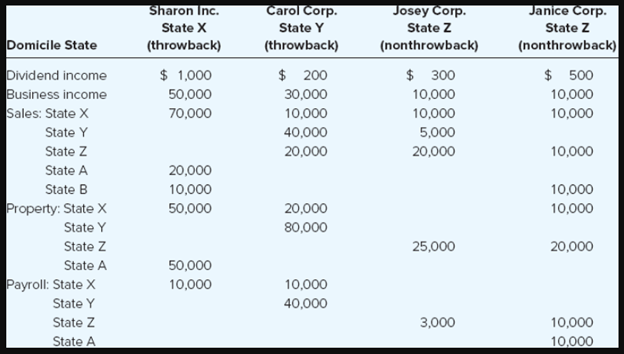

Sales Payroll Property lowa 69.20% 88.00 72.42 Missouri 32.01% 3.50 24.04 Domicile State Dividend income Business income Sales: State X State Y State Z State A State B Property: State X State Y State Z State A Payroll: State X State Y State Z State A Sharon Inc. State X (throwback) $ 1,000 50,000 70,000 20,000 10,000 50,000 50,000 10,000 Carol Corp. State Y (throwback) $ 200 30,000 10,000 40,000 20,000 20,000 80,000 10,000 40,000 Josey Corp. State Z (nonthrowback) $ 300 10,000 10,000 5,000 20,000 25,000 3,000 Janice Corp. State Z (nonthrowback) $ 500 10,000 10,000 10,000 10,000 10,000 20,000 10,000 10,000

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a Iowa and Missouri both use a threefactor apportionment formula Description Iowa Missouri Sales 692...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60979739c1f81_27970.pdf

180 KBs PDF File

60979739c1f81_27970.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started