Answered step by step

Verified Expert Solution

Question

1 Approved Answer

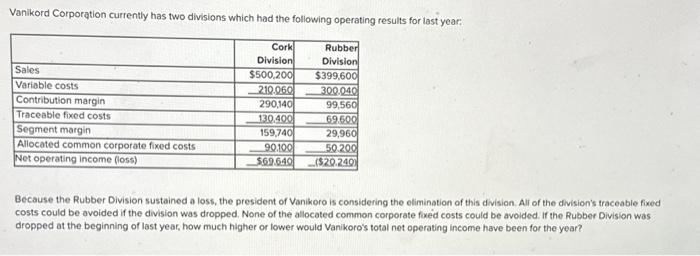

Vanikord Corporation currently has two divisions which had the following operating results for last year: Cork Division Rubber Division Sales $500,200 $399,600 Variable costs

Vanikord Corporation currently has two divisions which had the following operating results for last year: Cork Division Rubber Division Sales $500,200 $399,600 Variable costs 210.060 300.040 Contribution margin 290,140 99,560 Traceable fixed costs 130,400 69.600 Segment margin 159,740 29,960 Allocated common corporate fixed costs 90.100 50.200 Net operating income (loss) $69.640 ($20.240) Because the Rubber Division sustained a loss, the president of Vanikoro is considering the elimination of this division. All of the division's traceable fixed costs could be avoided if the division was dropped. None of the allocated common corporate fixed costs could be avoided. If the Rubber Division was dropped at the beginning of last year, how much higher or lower would Vanikoro's total net operating income have been for the year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the change in Vanikoros total net operating income if the Rubber Division were droppedwe need to analyze the impact on both the segment margin and the allocated common corporate fixed cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started