Question

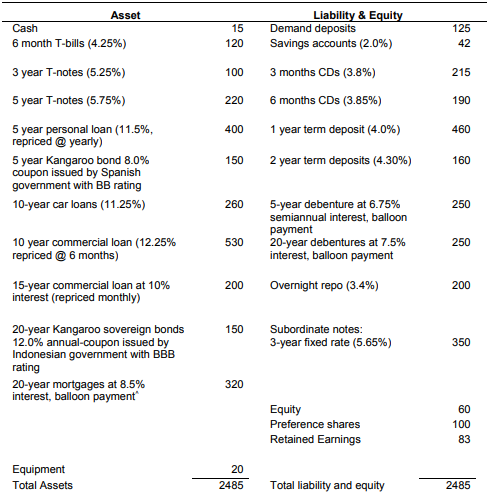

The book value of Dragon Slayer Bank?s balance sheet is listed below. Market yield are in parentheses. The amounts are in millions. 1. What is

The book value of Dragon Slayer Bank?s balance sheet is listed below. Market yield are in parentheses. The amounts are in millions.

1. What is the maturity gap of the bank?

2. What is the reprising gap if the planning period is 1 year and 2 years?

3. What is the duration gap of the bank of its assets and liability that falls within the maturity of 5 years and 10 years?

4. What if current market interest is 5.65%, What is the impact over the next six months on net interest income if interest on the banks rate sensitive assets decrease by 50 basis points and rate-sensitive liabilities decreased 25 basis points?

5. Due to the uncertainty in the economy, based on the bank?s estimate there is a potential of increase in the short term deposits. What are some of the impact may that have on the bank?s overall asset-liability?

6. If you are working at the asset liability management division of the bank, propose some of the strategies you could do to reduce the volatility of the value of equity?

7. Does the bank have sufficient liquid capital to cushion any unexpected losses as per the Basle III requirement?

Asset Cash 6 month T-bills (4.25%) 3 year T-notes (5.25%) 5 year T-notes (5.75%) 5 year personal loan (11.5%, repriced @ yearly) 5 year Kangaroo bond 8.0% coupon issued by Spanish government with BB rating 10-year car loans (11.25%) 10 year commercial loan (12.25% repriced @ 6 months) 15-year commercial loan at 10% interest (repriced monthly) 20-year Kangaroo sovereign bonds 12.0% annual-coupon issued by Indonesian government with BBB rating 20-year mortgages at 8.5% interest, balloon payment Equipment Total Assets 15 120 100 220 400 150 260 530 200 150 320 20 2485 Liability & Equity Demand deposits Savings accounts (2.0%) 3 months CDs (3.8%) 6 months CDs (3.85%) 1 year term deposit (4.0%) 2 year term deposits (4.30%) 5-year debenture at 6.75% semiannual interest, balloon payment 20-year debentures at 7.5% interest, balloon payment Overnight repo (3.4%) Subordinate notes: 3-year fixed rate (5.65%) Equity Preference shares Retained Earnings Total liability and equity 125 42 215 190 460 160 250 250 200 350 60 100 83 2485

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Maturity gap of the bank The maturity gap of the bank is years because all the investments and the liabilities that are maturing at the end are 20 years So the maturity gap of the bank is 20 years t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started