Question

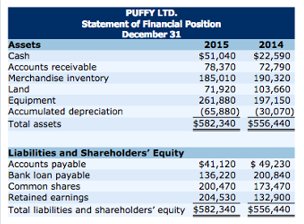

The comparative unclassified statement of financial position for Puffy Ltd. Follows: Additional information: 1. Profit was $104,880. 2. Sales were $970,160. 3. Cost of goods

The comparative unclassified statement of financial position for Puffy Ltd. Follows:

Additional information:

1. Profit was $104,880.

2. Sales were $970,160.

3. Cost of goods sold was $751,130.

4. Operating expenses were $43,950, exclusive of depreciation expense.

S. Depreciation expense was $35,810.

6. Interest expense was $14,240.

7. Income tax expense was $25,720.

8. Land was sold at a gain of $5,570.

9. No equipment was sold during the year.

10. $64,620 of the bank loan was repaid dunng the year.

11. Common shares were issued for $27,000.

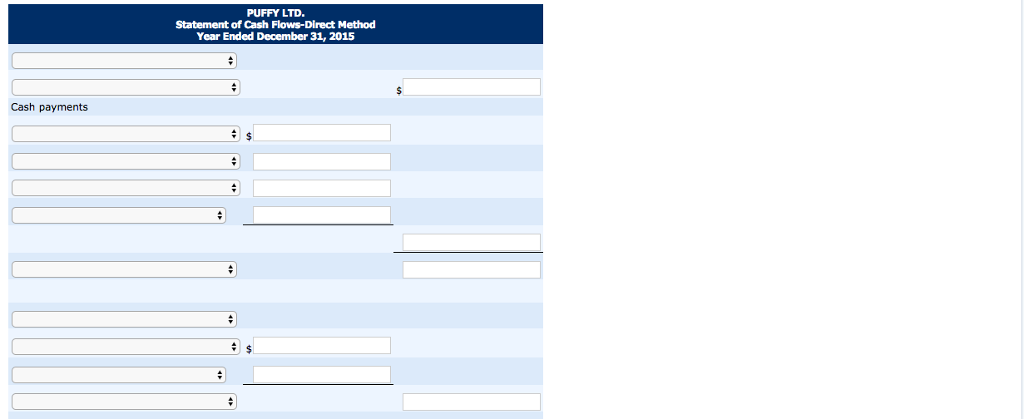

Prepare a statement of cash flows using the direct method.

PUFFY LTD. Statement of Financial Position December 31 Assets Cash Accounts receivable Merchandise inventory Land Equipment Accumulated depreciation Total assets Liabilities and Shareholders' Equity Accounts payable Bank loan payable Common shares Retained earnings 2015 $51,040 78,370 185,010 2014 $22,590 72,790 190,320 71,920 103,660 261,880 197,150 (65,880) (30,070) $582,340 $556,440 $41,120 $49,230 136,220 200,840 200,470 173,470 204,530 132,900 Total liabilities and shareholders' equity $582,340 $556,440 Cash payments PUFFY LTD. Statement of Cash Flows-Direct Method Year Ended December 31, 2015 # # + # # # # # $ + + # # # Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started