Question

The following details have been extracted from the budget of a merchandiser. Commission and salaries expenses are paid 50% in the month to which they

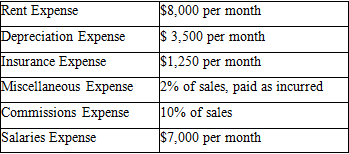

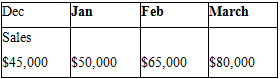

The following details have been extracted from the budget of a merchandiser.

Commission and salaries expenses are paid 50% in the month to which they relate and the balance in the next month.

Rent and miscellaneous expenses are paid as and when they occur. Insurance is prepaid at the beginning of the quarter. Calculate cash payments for the selling and administrative expenses for the first quarter of the next year.

Rent Expense Depreciation Expense Insurance Expense Miscellaneous Expense Commissions Expense Salaries Expense $8,000 per month $ 3,500 per month $1,250 per month 2% of sales, paid as incurred 10% of sales $7,000 per month Dec Sales $45,000 $50,000 Jan Feb $65,000 March $80,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Budgeted Cash Payments for Selling and Administrative Expenses Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

10th edition

1473748873, 9781473748910 , 1473748917, 978-1473748873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App