Question

The following inventory transactions apply to Green Company for Year 2: Jan. 1 Purchased 290 units @ $ 10 Apr. 1 Sold 145 units @

The following inventory transactions apply to Green Company for Year 2:

| Jan. 1 | Purchased | 290 | units | @ | $ | 10 | |

| Apr. 1 | Sold | 145 | units | @ | $ | 20 | |

| Aug. 1 | Purchased | 440 | units | @ | $ | 11 | |

| Dec. 1 | Sold | 550 | units | @ | $ | 21 | |

The beginning inventory consisted of 175 units at $11 per unit. All transactions are cash transactions.

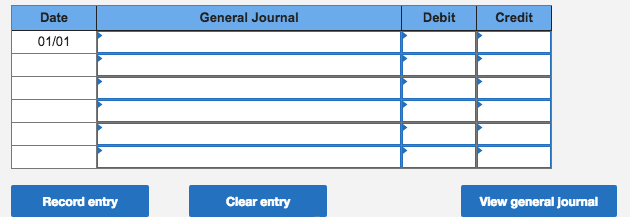

Required: a. Record these transactions in general journal format assuming Green uses the FIFO cost flow assumption and keeps perpetual records.

1. Record entry inventory purchased for cash.

2. Record sale of inventory for cash.

3. Record entry for cost of goods sold.

4. Record entry inventory purchased for cash.

5. Record sale of inventory for cash.

6. Record entry for cost of goods sold.

Record entry inventory purchased for cash.

b. Compute cost of goods sold for year 2.

Date 01/01 Record entry General Journal Clear entry Debit Credit View general Journal

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a 1Jan Merchandise inventory 2900 29010 Cash 2900 1Apr Cash 2900 1452...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6096ee3cef3ad_27331.pdf

180 KBs PDF File

6096ee3cef3ad_27331.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started