Answered step by step

Verified Expert Solution

Question

1 Approved Answer

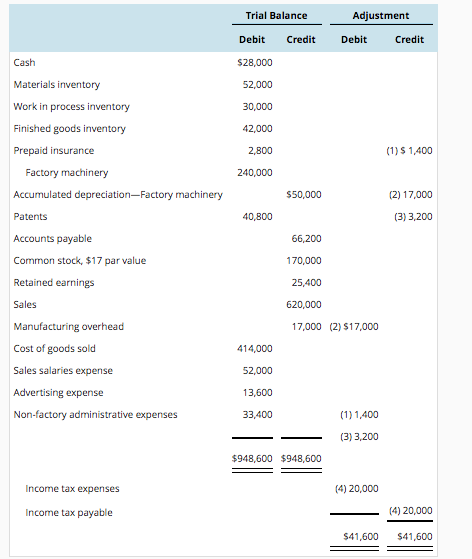

The following is the trial balance of Hyde Company at December 31, 2016, together with the worksheet adjustments. Hyde Company uses perpetual inventory procedures. Additional

The following is the trial balance of Hyde Company at December 31, 2016, together with the worksheet adjustments. Hyde Company uses perpetual inventory procedures.

Additional information:

1. January 1, 2016, inventories were materials, $36,000; work in process, $27,800; and finished goods, $42,000.

2. Net delivered cost of materials purchased was $142,800.

3. Direct labor was $180,800.

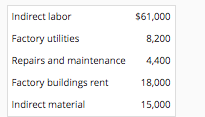

4. Manufacturing overhead included the following:

Required

a.Complete the worksheet

b.Prepare an income statement

Cash Materials inventory Work in process inventory Finished goods inventory Prepaid insurance Factory machinery Accumulated depreciation-Factory machinery Patents Accounts payable Common stock, $17 par value Retained earnings Sales Manufacturing overhead Cost of goods sold Sales salaries expense Advertising expense Non-factory administrative expenses Income tax expenses Income tax payable Trial Balance Debit Credit $28,000 52,000 30,000 42,000 2,800 240,000 40,800 414,000 52,000 13,600 33,400 $50,000 Adjustment $948,600 $948,600 Debit 66,200 170,000 25,400 620,000 17,000 (2) $17,000 (1) 1,400 (3) 3,200 (4) 20,000 $41,600 Credit (1) $1,400 (2) 17,000 (3) 3,200 (4) 20,000 $41,600 Indirect labor Factory utilities Repairs and maintenance Factory buildings rent Indirect material $61,000 8,200 4,400 18,000 15,000

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cost of goods manufactured and sold Direct material Beginning materials inventory 36000 Add Purchase...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started