Answered step by step

Verified Expert Solution

Question

1 Approved Answer

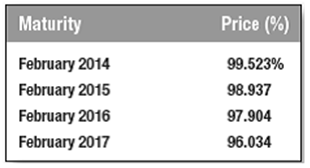

The following table shows the prices of a sample of U.S. Treasury strips in February 2012. Each strip makes a single payment of $1,000 at

The following table shows the prices of a sample of U.S. Treasury strips in February 2012. Each strip makes a single payment of $1,000 at maturity.

a. Calculate the annually compounded, spot interest rate for each year.

b. Is the term structure upward- or downward-sloping or flat?

c. Would you expect the yield on a coupon bond maturing in February 2017 to be higher or lower than the yield on the 2014 strip?

Maturity February 2014 February 2015 February 2016 February 2017 Price (%) 99.523% 98.937 97.904 96.034

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The price of each strip that matures in different year is different They make single payment only ie ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6095d010a13d0_26280.pdf

180 KBs PDF File

6095d010a13d0_26280.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started