Question

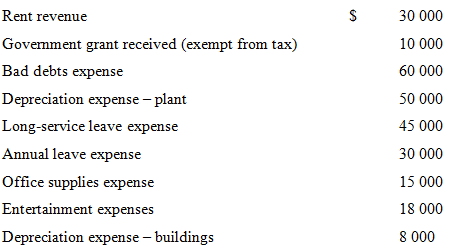

The profit before tax of Perfect Skin Ltd for the year ended 30 June 2017 is $600 000 and includes the following revenue and expense

The profit before tax of Perfect Skin Ltd for the year ended 30 June 2017 is $600 000 and includes the following revenue and expense items:

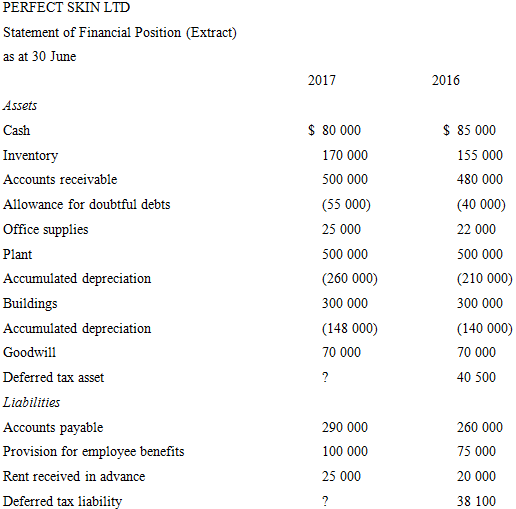

Extracts from the statements of financial position of the company at 30 June 2017 and 30 June 2016 showed the following assets and liabilities:

Additional information

? Entertainment costs and depreciation of buildings are not allowed as tax deductions. The buildings are also not subject to capital gains tax. The government grants revenue is not assessable for tax purposes.

? Accumulated depreciation of plant for tax purposes was $315 000 at 30 June 2016, and depreciation for tax purposes for the year ended 30 June 2017 amounted to $75 000.

? Office supplies are claimed as a tax deduction when purchased. Rent is taxed when received.

? Assume a tax rate of 30% for the year ended 30 June 2017.

A. Prepare a current tax worksheet for the year ended 30 June 2017 to calculate taxable income and the company?s current tax liability, and then record the entries for current tax.

B. Prepare a deferred tax worksheet as at 30 June 2017 to calculate the end-of-period adjustments required for the deferred tax asset and liability accounts, and then record the entries for deferred tax.

C. Assume that the government decided, after the election in August 2016, to change the income tax rate for the year ended 30 June 2017 from 30% to 35%. Show the impact of the change in the tax rate on the journal entries prepared under requirements A and B, and prepare any additional entries that may be required.

Rent revenue Government grant received (exempt from tax) Bad debts expense Depreciation expense - plant Long-service leave expense Annual leave expense Office supplies expense Entertainment expenses Depreciation expense - buildings SA 30 000 10 000 60 000 50 000 45 000 30 000 15 000 18 000 8 000 PERFECT SKIN LTD Statement of Financial Position (Extract) as at 30 June Assets Cash Inventory Accounts receivable Allowance for doubtful debts Office supplies Plant Accumulated depreciation Buildings Accumulated depreciation Goodwill Deferred tax asset Liabilities Accounts payable Provision for employee benefits Rent received in advance Deferred tax liability 2017 $ 80 000 170 000 500 000 (55 000) 25 000 500 000 (260 000) 300 000 (148 000) 70 000 ? 290 000 100 000 25 000 ? 2016 $ 85 000 155 000 480 000 (40 000) 22 000 500 000 (210 000) 300 000 (140 000) 70 000 40 500 260 000 75 000 20 000 38 100

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A Current Tax Worksheet For the year ended 30 June 2017 Accounting profit before tax 600 000 Add Entertainment expenses 18 000 Depreciation expense buildings 8 000 Bad debts expense 60 000 Depreciatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started