Question

The Rafi M. Company, which has been in business for three years, makes all of its sales on credit and does not offer cash discounts.

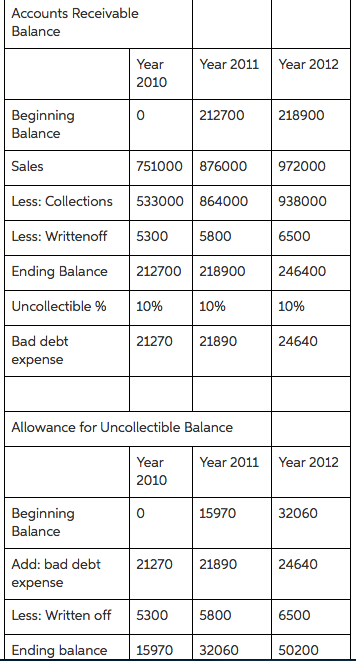

The Rafi M. Company, which has been in business for three years, makes all of its sales on credit and does not offer cash discounts. Credit sales, customer collections, and write offs of uncollectible accounts for its first three years follow: Year 2010, Sales $751,000, collections $533,000, Accounts written off $5,300. Year 2011, Sales, 876,000, collections 864,000, accounts written off 5,800. Year 2012, sales 972,000, collections 938,000, accounts written off 6,500.

Rafi M. estimates uncollectibles to be 10% of accounts receivable. Identify the ending balance amount on the accounts receivable and the allowance for uncollectibile accounts reported on the balance sheet for each of the three years and the total amount of bad debt expense that appears on the income.

A consultant suggested using the income statement approach for determination of bad debt expense. What percentage would yield the same balance for the allowance for uncollectible accounts at the end of 2012, as is under the currently used method?

Accounts Receivable Balance Beginning Balance Sales Less: Collections Less: Writtenoff Ending Balance Uncollectible % Bad debt expense Beginning Balance Year 2010 Add: bad debt expense Less: Written off Ending balance 0 751000 876000 533000 864000 5300 5800 10% Year 2011 212700 218900 212700 Allowance for Uncollectible Balance Year 2010 21270 21890 0 5300 10% 15970 Year 2011 21270 21890 15970 5800 32060 Year 2012 218900 972000 938000 6500 246400 10% 24640 Year 2012 32060 24640 6500 50200

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Under income statement approach for determination bad debts a certain per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started