Question

The State Unemployment Tax Act, better known as SUTA, is a form of payroll tax that all states require employers to pay for their employees.

The State Unemployment Tax Act, better known as SUTA, is a form of payroll tax that all states require employers to pay for their employees. SUTA is a counterpart to FUTA, the federal unemployment insurance program. A

The Federal Unemployment Tax Act (or FUTA, I.R.C. ch. 23) is a United States federal law that imposes a federal employer tax used to help fund state workforce agencies. Employers report this tax by filing an annual Form 940 with the Internal Revenue Service. A Complete the following steps:

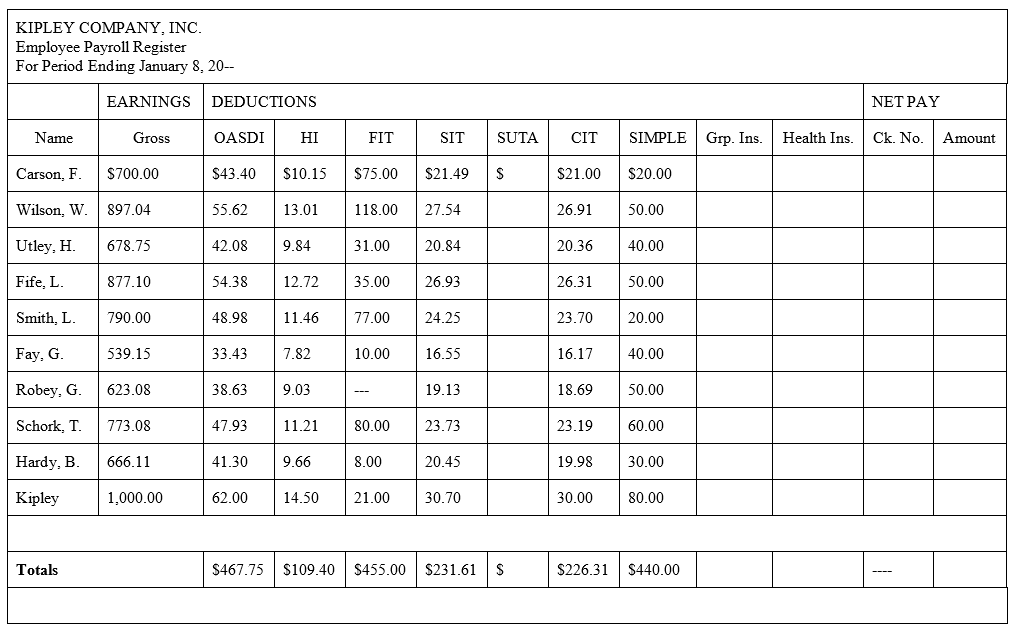

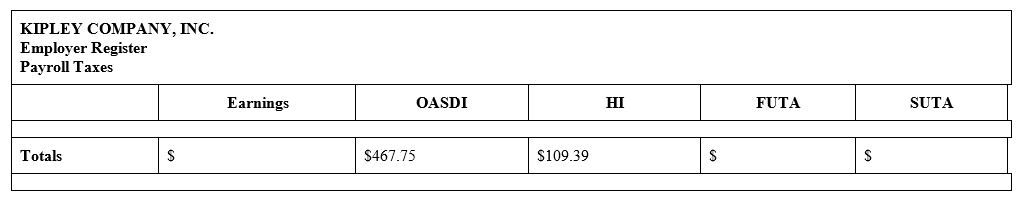

Net FUTA tax: Since this is the first pay period of the year, none of the employees are near the $7,000 ceiling; therefore, each employee?s gross earnings is subject to the FUTA tax. (The employer rate is 0.6%)

SUTA tax: Since Kipley Company is a new employer, Pennsylvania has assigned the company a contribution rate of 3.6785% on the first $9,750 of each employee?s earnings.

Requirements;

1) Compute and record the employee's SUTA contributions.

2) Compute and record the Kipley Company's SUTA and FUTA contributions.

KIPLEY COMPANY, INC. Employee Payroll Register For Period Ending January 8, 20-- Name Carson, F. Wilson, W. Utley, H. Fife, L. Smith, L. Fay, G. Robey, G. Schork, T. ardy, B. Kipley Totals EARNINGS Gross $700.00 897.04 678.75 877.10 790.00 539.15 623.08 773.08 666.11 1,000.00 DEDUCTIONS OASDI HI $43.40 $10.15 $75.00 55.62 42.08 54.38 33.43 38.63 47.93 13.01 9.84 62.00 12.72 48.98 11.46 77.00 7.82 9.03 11.21 41.30 9.66 FIT 14.50 31.00 118.00 27.54 35.00 10.00 80.00 8.00 SIT SUTA CIT 21.00 $21.49 20.84 26.93 24.25 16.55 19.13 23.73 20.45 30.70 S $467.75 $109.40 $455.00 $231.61 S $21.00 26.91 20.36 26.31 23.70 16.17 18.69 23.19 SIMPLE 30.00 $20.00 50.00 40.00 50.00 20.00 40.00 50.00 60.00 19.98 30.00 80.00 $226.31 $440.00 Grp. Ins. Health Ins. NET PAY Ck. No. Amount KIPLEY COMPANY, INC. Employer Register Payroll Taxes Totals S Earnings $467.75 OASDI $109.39 HI S FUTA S SUTA

Step by Step Solution

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 The table with employees SUTA contributions is completed as below KIPLEY COMPANY INC Employee ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

609224da72c55_22809.pdf

180 KBs PDF File

609224da72c55_22809.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started