Question

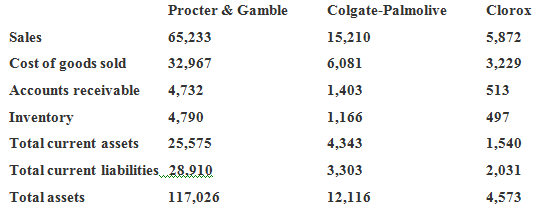

The table, shows key financial data for three firms that compete in the consumer products market: Procter & Gamble, Colgate-Palmolive, and Clorox. a. Calculate each

The table, shows key financial data for three firms that compete in the consumer products market: Procter & Gamble, Colgate-Palmolive, and Clorox.

a. Calculate each of the following ratios for all three companies: current ratio, quick ratio, inventory turnover, average collection period, total asset turnover.

b. What company is in the position of having greatest liquidity?

c. Would you say that the three companies exhibit similar performance or quite different performance in terms of collecting receivables? Why do you think that might be?

d. Which company has the most rapid inventory turnover? Which company appears to be least efficient in terms of total asset turnover? Are your answers to those questions a little surprising? If a company is best at inventory turnover and worst at total asset turnover, what do you think that means?

Procter & Gamble Sales 65,233 Cost of goods sold 32,967 Accounts receivable 4,732 Inventory 4,790 Total current assets 25,575 Total current liabilities 28.910 Total assets 117,026 Colgate-Palmolive 15,210 6,081 1,403 1,166 4,343 3,303 12,116 Clorox 5,872 3,229 513 497 1,540 2,031 4,573

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a b answer Colgate Palmolive c quite different performance in terms of collection period bec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started