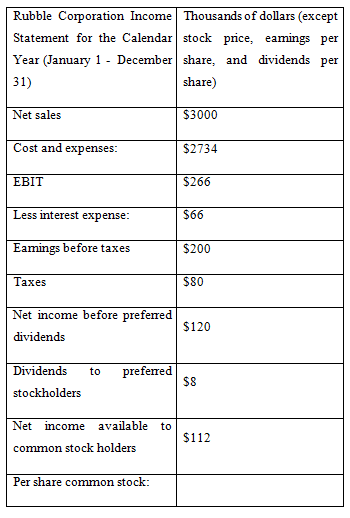

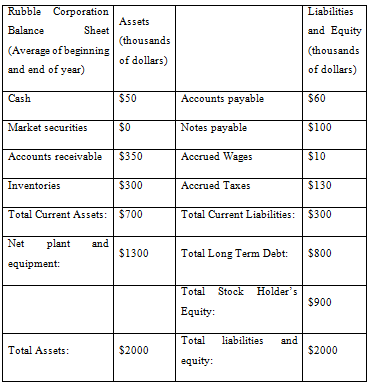

Question: This question is based on the information provided in the abbreviated year-end Income Statement and abbreviated year-end Balance Sheet for Rubble Corporation shown below. a.

This question is based on the information provided in the abbreviated year-end Income Statement and abbreviated year-end Balance Sheet for Rubble Corporation shown below.

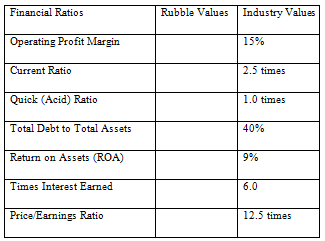

a. Calculate the Rubble financial ratios contained in the following table

b. How is the ratio Return on Assets (ROA), from part 8a above, influenced by both net profit margin and total asset turnover? Support your answer with appropriate analyses.

c. Compare your results to the industry ratios and describe what Rubble Co. should do to improve its position in the market.

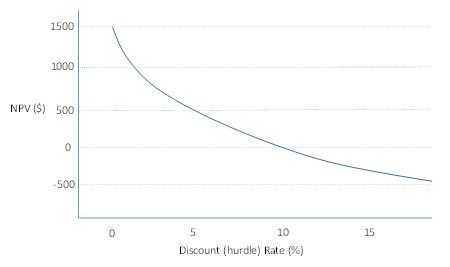

4. Based on the NPV profile shown below, what is the approximate internal rate of return (IRR)

Rubble Corporation Income Thousands of dollars (except Statement for the Calendar stock price, eamings per Year (January 1 - December share, and dividends per 31) share) Net sales $3000 Cost and expenses: EBIT Less interest expense: Eamings before taxes Taxes Net income before preferred dividends Dividends to preferred stockholders Net income available to common stock holders Per share common stock: $2734 $266 $66 $200 $80 $120 $8 $112 Rubble Corporation Balance Sheet (Average of beginning and end of year) Cash Market securities Inventories Assets (thousands of dollars) Accounts receivable $350 equipment: $50 Total Assets: $0 Total Current Assets: $700 Net plant and $300 $1300 $2000 Accounts payable Notes payable Accrued Wages Accrued Taxes Total Long Term Debt: Total Stock Stock Equity: $130 Total Current Liabilities: $300 Holder's Liabilities and Equity (thousands of dollars) Total liabilities and equity: $60 $100 $10 $800 $900 $2000 Financial Ratios Operating Profit Margin Current Ratio Quick (Acid) Ratio Total Debt to Total Assets Return on Assets (ROA) Times Interest Earned Price/Earnings Ratio Rubble Values Industry Values 15% 2.5 times 1.0 times 40% 9% 6.0 12.5 times 1500 1000 NPV ($) 500 0 -500 0 5 10 Discount (hurdle) Rate (%) 15

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

To tackle this problem lets break it down step by step a Calculating the Financial Ratios 1 Operating Profit Margin textOperating Profit Margin fracte... View full answer

Get step-by-step solutions from verified subject matter experts