Question

Use most recent year ANNUAL financial statements from Yahoo! Calculate following ratios. Explain why Microsoft has a HIGHER / LOWER ROE than Ford by breaking

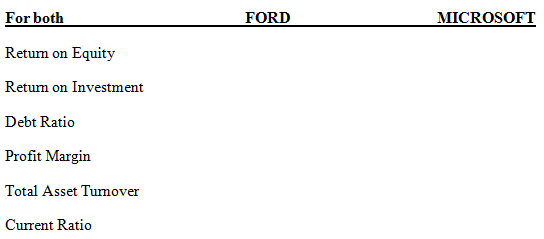

Use most recent year ANNUAL financial statements from Yahoo! Calculate following ratios.

Explain why Microsoft has a HIGHER / LOWER ROE than Ford by breaking ROE down into the Debt Ratio, Profit Margin and Total Asset Turnover; i.e. what ratio(s) drove ROE to be different.

For both Return on Equity Return on Investment Debt Ratio Profit Margin Total Asset Turnover Current Ratio FORD MICROSOFT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

INTRODUCTION This main pivotal of this report is the financial ratio comparison of two companies FORD and MICROSOFT for the year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App