Answered step by step

Verified Expert Solution

Question

1 Approved Answer

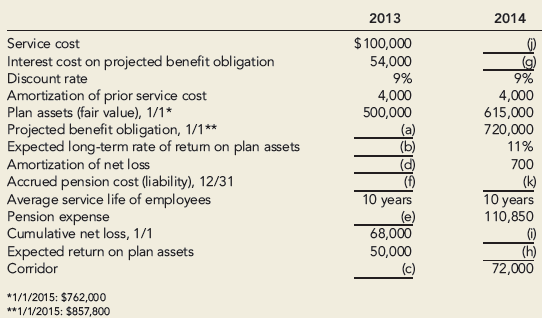

Various pension plan information of Kerem Company for 2013 and 2014 is as follows: Required: Fill in the blanks lettered (a) through (k). Enter amounts

Various pension plan information of Kerem Company for 2013 and 2014 is as follows:

Required:

Fill in the blanks lettered (a) through (k). Enter amounts as positive numbers.

Service cost Interest cost on projected benefit obligation Discount rate Amortization of prior service cost Plan assets (fair value), 1/1* Projected benefit obligation, 1/1** Expected long-term rate of return on plan assets Amortization of net loss Accrued pension cost (liability), 12/31 Average service life of employees Pension expense Cumulative net loss, 1/1 Expected return on plan assets Corridor *1/1/2015: $762,000 **1/1/2015: $857,800 2013 $100,000 54,000 9% 4,000 500,000 (b) (f) 10 years 68,000 50,000 (c) 2014 9% 4,000 615,000 720,000 11% 700 (k) 10 years 110,850 (h) 72,000

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

A Projected benefit obligation 54000 9 2013 project benefi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60912f9f813c2_22194.pdf

180 KBs PDF File

60912f9f813c2_22194.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started